Multiply Your Crypto Holdings: A Guide how to use your own project and earn additional profit on crypto arbitrage

with ArbitrageScanner!

A Case of Self-Project Arbitrage.

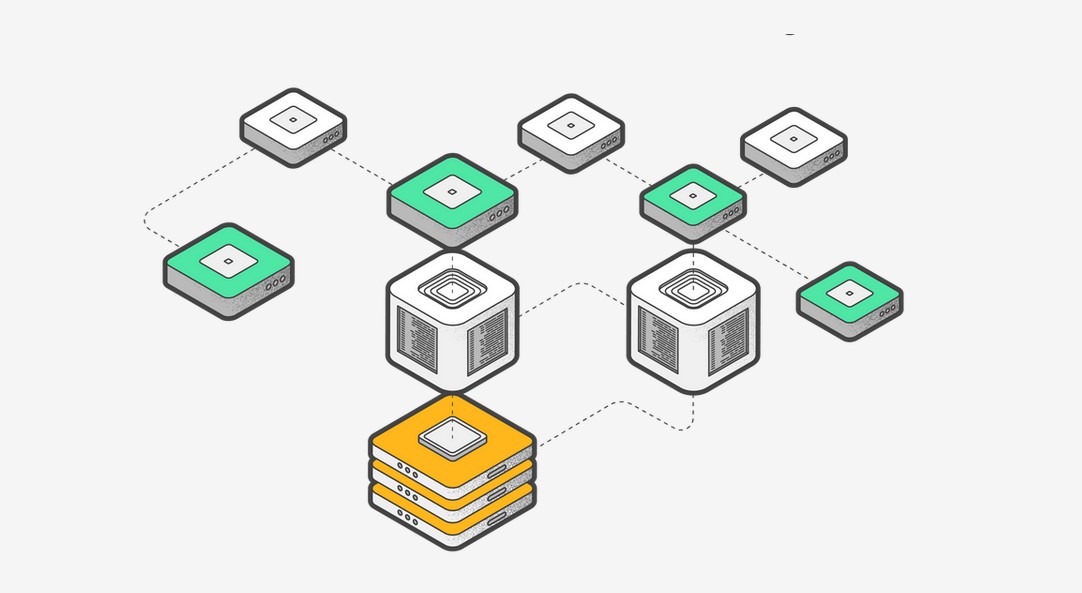

Let's assume you are the owner of your own coins, and you want to multiply your funds. Often, small projects do not have market makers, but even if they do, this case will be relevant for you.

Let's say your coin is traded on the Pancake and Gate exchanges.

As the coin owner, you can utilize our arbitrage bot, which helps automate the process of detecting and exploiting price gaps between the Pancake and Gate platforms. This method allows owners to reduce risks and gain additional profit by efficiently utilizing price discrepancies on both platforms.

You connect the arbitrage bot to your coin, and the bot automatically identifies spreads between the platforms. It sends notifications about potential arbitrage trades, pointing out advantageous price differences. As the owner, you then engage in arbitrage.

Operating on traditional exchanges (e.g., Gate) might involve fees of $70 per trade, while using decentralized exchanges (e.g., Pancake) could cost $200. Despite this, even accounting for fees, coin owners can recoup the costs after just 2-3 successful arbitrage trades.

Cryptocurrency arbitrage within your own project offers coin owners the opportunity to significantly boost their profits. This method is particularly relevant when there's no market maker on the exchange, but can also be applied even if one is present.

In the previous arbitrage case, we talked about: Coin-to-Coin arbitrage strategies: BTC, ETH, etc.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.