Coin-to-Coin arbitrage strategies: BTC, ETH, etc.

with ArbitrageScanner!

A lot of people focus on arbitrage to the dollar, but in reality, you can engage in arbitrage between other coins, such as BTC, ETH, and others, where the price difference is significantly higher. A combination of larger and smaller exchanges, like Binance and smaller ones like YOBIT, demonstrates good results.

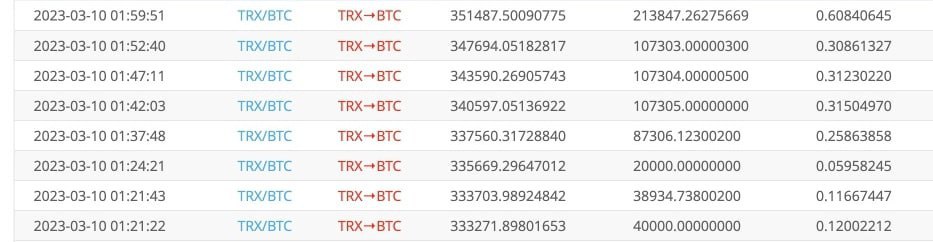

As an example, let's consider what happened when there was a cryptocurrency crash caused by claims against the KuCoin exchange by the US.

“The Chief Executive of the New York State Attorney General's Office, Letitia James, filed a lawsuit against KuCoin, accusing it of violating securities laws by offering tokens without the proper license. It is reported that the cryptocurrency exchange acted without registering as a broker-dealer and 'improperly presented itself as a platform.' Authorities also raise questions about the KuCoin Earn product.”

It is precisely such news that creates significant opportunities for arbitrage between exchanges, both in a positive and a negative sense.

For example, TRX fell by about 8 percent relative to BTC, and arbitrage in this case yielded roughly the same percentage profit.

It's important to note that predicting short-term cryptocurrency movements is difficult, but arbitrage is a pleasant bonus. The main point in this case is that there are pairs not only with the dollar but also with other coins, such as BTC, ETH, XRP and others.

In the previous arbitrage case, we talked about: Case Study of Arbitrage for P2P Traders: Local Exchange + Major Exchange

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.