How funds and market makers profited from the market downturn

with ArbitrageScanner!

Bloody monday or how funds and market makers profited from it

On the first Monday of August, a significant liquidation of Bitcoin occurred, leading to a massive sell-off and a price drop below $50,000. This $10,000 decline weakened the confidence of traders and investors. The primary cause was the liquidation of $1 billion, which triggered a cascading price drop and an increase in market volume.

As a result, by August 5, the price of altcoins was lower than at the start of the 2022-2023 bear cycle. Over August 4-5, market liquidations amounted to nearly $2 billion. Bitcoin's dominance reached 58%, setting a new record for over 700 days. Panic and widespread liquidations forced many traders to sell altcoins at a loss.

How major players act during market downturns

Market makers and funds have access to insider information and immense resources, making them key players in market management. Beyond news, market dumps can be directly linked to these large transfers. The biggest players moved significant amounts of ETH to exchanges, creating selling pressure and potentially driving prices down.

Since August 3, five leading market makers have transferred over 130,000 ETH to centralized exchanges (CEX), amounting to approximately $300 million. Wintermute alone transferred 2,691 ETH to CEX, equivalent to $6.1 million. This transfer included sending ETH to block builders, Robinhood, and Cumberland DRW, as well as wrapping some of the assets into wETH, demonstrating the diverse strategies the company employs to manage its assets

Wintermute transferred 2,691 ETH, equivalent to $6.1 million, to centralized exchanges (CEX). This transfer included sending ETH to blockchain builders, Robinhood and Cumberland DRW, as well as wrapping a portion of the funds in wETH, which demonstrates the variety of strategies the company employs to manage its assets.

Wallet: https://wallet.arbitragescanner.io/0x51C72848c68a965f66FA7a88855F9f7784502a7F

Jump Trading made a significant transfer of 28,000 ETH to centralized exchanges, amounting to approximately $63.6 million. This move highlights the company's active involvement in liquidity management and potential intentions to manipulate market dynamics

https://wallet.arbitragescanner.io/0x4E4398F4b7683F721aDD73FC515D7db4F1A4Df6e

Recovery of the Crypto Market

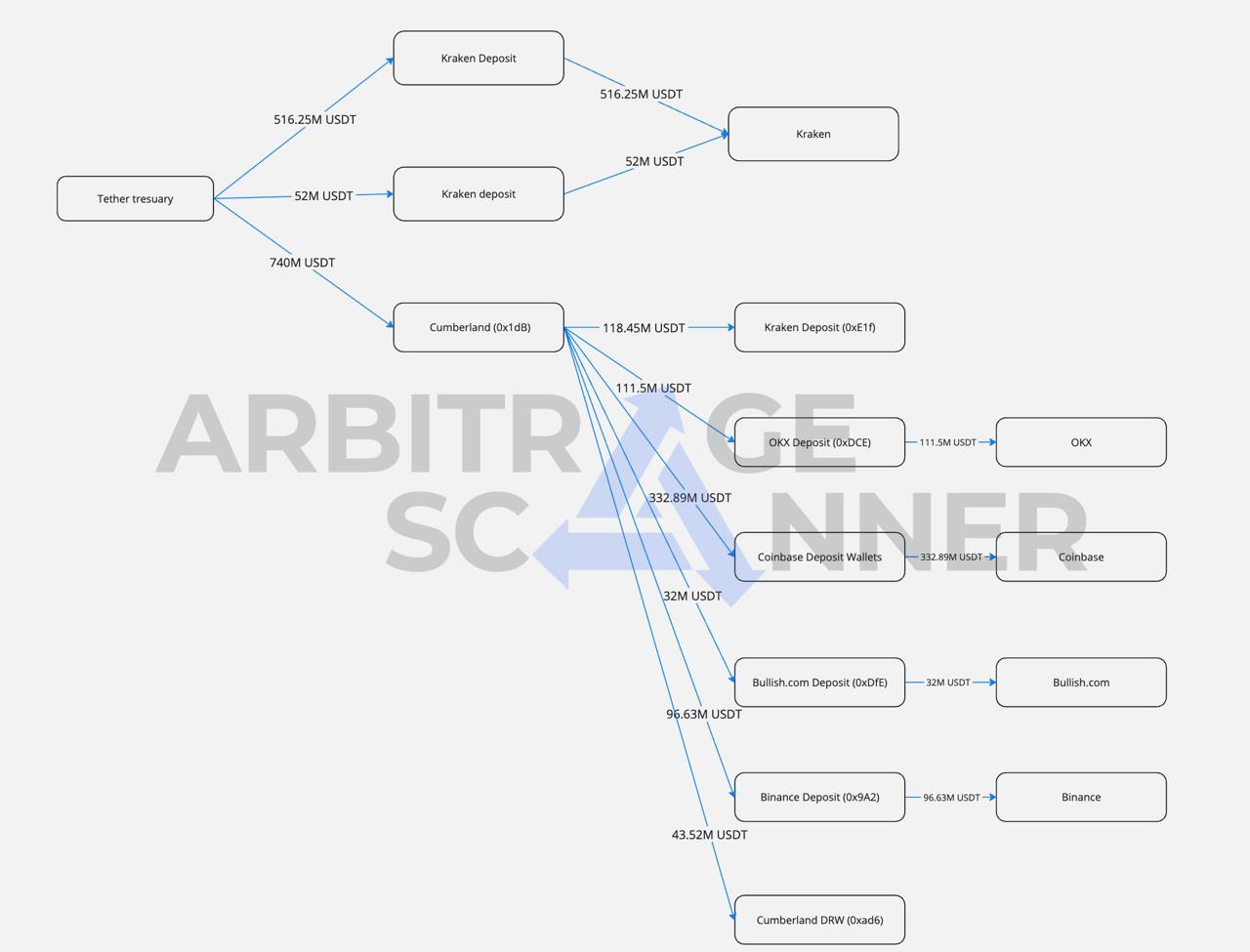

Amid the panic-driven sell-off of cryptocurrencies, where many investors rushed to liquidate their assets, large institutional players seized the opportunity to strengthen their positions. Over the past four days, approximately $1.3 billion in USDT has been transferred to centralized exchanges (CEX)

Within 24 hours, the wallet with the address 0x1db (likely belonging to Cumberland) transferred $270 million USDT from Tether Treasury to major exchanges, coinciding with the market's recovery. The remaining $900+ million was distributed across various CEX platforms.

After the market crash on August 5, this wallet received $660 million USDT from Tether and subsequently transferred $607.3 million USDT to various exchanges, including:

- $333 million to Coinbase,

- $118.5 million to Kraken,

- $72.4 million to Binance,

- $51.5 million to OKX,

- $32 million to Bullish.

Another notable example: The company "7 Siblings," holding assets worth $1.57 billion, quietly acquired 56,093 ETH worth $129 million at the market's lowest point!

They began purchasing when the price dropped to $2,600 and continued buying ETH as the price fell to $2,191, making purchases over a 12-hour period. The average purchase price was $2,305

Their wallet address: https://wallet.arbitragescanner.io/0x741AA7CFB2c7bF2A1E7D4dA2e3Df6a56cA4131F3?ref=G0TZ3FHW9D

If you're unsure where to find the wallets of funds and market makers, we have convenient collections:

- Market Makers

- Funds

- Celebrities

Explore these collections and stay ahead of the curve. We also recommend reading the guide on how to use the collections - [link].

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.