Crypto Whales: How to Track the Big Players?

Who are Crypto Whales and How to Observe Them

Financial markets depend on the behavior of the crowd, or traders: depending on what patterns market participants see on the chart, further price movement is possible. However, crypto whales can interfere with this, especially in the crypto market.

In this article, we will tell you in detail who crypto whales are, how to track the movement of their digital assets, what metrics you need to focus on, and much more.

Who are Crypto Whales?

A crypto whale is a large holder of cryptocurrency. They are called whales for a reason: if they withdraw all their savings to the market and try to sell, it will undoubtedly affect the value of the asset, at least in the short term. The analogy with a whale is that when a sea creature surfaces and dives back, it creates a wave that affects nearby objects. Crypto whales also influence other market participants at the moment of selling their assets: specialized services and forums start talking about it, and if the whale is large by market standards, even the media might write about it.

For each cryptocurrency, a whale is identified differently: for example, bitcoin crypto whales must have at least 10,000 BTC in their wallet to be considered a large holder. If we take some young projects with small capitalization, then crypto whales here can start from tokens worth hundreds of thousands of dollars or even less.

One of the first cases when a bitcoin whale influenced the price of BTC is considered to be the beginning of October 2014. At that time, a downward trend began to be traced in bitcoin, and the average price of the asset was $370. By October 5, the quotes of the main cryptocurrency dropped to $325, and at that moment an unknown trader put 30,000 BTC up for sale at a price of $300. Of course, this order was quickly bought up, which triggered a decrease in the value of bitcoin to $275 in just a day. This trader later commented on the BitcoinTalk forum: he had no intention of crashing the price of the main cryptocurrency – he just needed money and didn't think about the consequences.

However, in 2025, crypto whales understand their influence on the market, and it is quite difficult to find someone who would specifically dump a large amount of an asset onto the market in the hope of crashing its value. Today everything works a bit differently: whales work carefully, and other market participants have long learned to track the movement of their cryptocurrencies, which gives them a kind of insider knowledge about the further movement of the asset's price.

What is On-chain Analysis

On-chain analysis is the tracking of information within the blockchain: how many holders a cryptocurrency has, what transactions were made at an address, the network hash rate, and much more. It is with the help of on-chain analysis that it is possible to track the deals of crypto whales, which can say a lot about the further direction of the asset's price.

Suppose you know the address of a crypto whale who holds a relatively popular token in large quantities. One day, you find that they have transferred all the tokens to an exchange – this indicates that the whale wants to sell them. If you have this token, it's better to follow the whale's example and sell it; otherwise, you might do it much cheaper: after a large amount of the asset enters the market, its price will decrease.

On-chain analysis gives crypto market participants what is not available in other markets – information about the movement of large capital. It would be much easier to build your investment strategy if, for example, stock operations were reflected in some special register, but it does not exist. The crypto market can provide such an opportunity to its participants, which is why their approach to investing can change for the better.

Differences Between Whales and Ordinary Crypto Holders

The main difference is the amount of cryptocurrency in the wallet. As already mentioned, bitcoin whales start from 10,000 BTC, maybe a bit less. An ordinary cryptocurrency holder may hold a hundredth of a bitcoin, for example, 0.001 BTC – with such an amount of an asset, they are unlikely to be able to influence the market.

However, there is another difference: crypto whales do not sell assets during market drawdowns. As a rule, holders of large amounts of cryptocurrency are well-versed in market processes and understand that if a digital asset has proven its worth (long history, high capitalization, technical application, many partnerships), its price will recover – it's a matter of time. Small holders have a different vision: as soon as the market starts to get "stormy," they immediately sell their savings, and considering there are many of them, it affects the value of the asset – it decreases.

In essence, both whales and small cryptocurrency holders can influence the market, but in the first case, one holder is enough, while in the second, a crowd is needed to start a panic sell-off.

How to Detect a Crypto Whale

To find a crypto whale's wallet, you need to track it using blockchain information, namely:

-

Find a cryptocurrency that has recently grown, but there were no reasons for it. There are many such cases, even with small capitalizations – the search will not be difficult;

-

Paste the token's contract address into blockchain explorers like Etherscan or BTCScan. Then, information about the holders of this cryptocurrency will become available to you, among which you need to select those wallets where a large number of digital assets are concentrated;

-

In general, this is already enough: you can regularly check this wallet for new transactions. However, it is better to use a service for on-chain analysis, for example, Arbitragescanner. With its help, you can get more detailed analytics on the wallet, as well as find similar ones, meaning you can have several addresses of crypto whales at once.

An important point: if crypto whale wallets are connected to each other (regular transactions are traced), these could be scammers who control a large amount of cryptocurrency and intend to sell all reserves at once, after which the price will crash.

Watching Whales: Should Crypto Investors Track Whale Activity?

It is definitely worth it. The point is that usually behind large capitals are people who have significant experience in financial markets. Many large investors came from traditional markets, seeing what kind of returns digital assets can provide. As a rule, whales, especially when talking about top cryptocurrencies, do not act alone: a team is behind the capital, conducting thorough analysis before making any trading operation.

In addition, large holders of cryptocurrency often have access to various insides about crypto projects. For example, a project is going to announce a partnership with a large traditional company that has been on the market for a long time. Will this affect the value of the project's token? Of course, yes – in a positive way. If a project is recognized by traditional companies and they enter into a partnership with it, it speaks of its viability, meaning the token will become more in demand than before. Knowing such information, you can buy the token in advance and wait for the news to become public.

Since crypto whales can bring impressive amounts to the capitalization of a project, they quite often receive such information. Therefore, it is definitely worth focusing on the deals of crypto whales, as they are based on thorough analytics and insights.

General Blockchain Metrics

Price Movements

Price movement can be easily correlated with basic blockchain data. For example, if the price of a cryptocurrency is decreasing, you can track how much of it is being deposited into centralized exchanges: if the amount is large, it indicates that investors are not going to stop and will continue to sell the asset. If inflows to crypto exchanges decrease, meaning the cryptocurrency is being withdrawn to crypto wallets, then market participants believe the bottom has been reached and a trend reversal is next.

Stock-to-Flow Ratio

This is the ratio of the circulating supply of a cryptocurrency to the newly entering coins:

-

Stock – the amount of cryptocurrency that already exists and is available on the market. For example, the number of bitcoins that have already been mined;

-

Flow – the amount of new coins being mined over a certain period of time, usually a year.

According to the ratio calculation rule, the higher the stock-to-flow ratio, the more the value of the cryptocurrency grows. Based on this, it is possible to determine the scarcity of the cryptocurrency on the market, depending on the arrival of new coins.

Let's take bitcoin as an example: every 10 minutes, a new block is added to the blockchain of the main cryptocurrency, for which miners receive a reward – 3.125 BTC. In an hour, 18.75 BTC will be mined, in a day – 450 BTC, in a year it will be 164,250 BTC – this is our flow. Today, about 19.84 million BTC are available on the market – this is our stock. To determine the stock-to-flow ratio, you need to divide the stock by the flow: 19,840,000 / 164,250 = 120.

The result of 120 is the number of years it would take to mine the already existing amount of BTC. It's clear that bitcoin won't be mined for that long (the limit of 21 million BTC will come earlier), however, the higher this indicator (considered high from 50), the greater the asset scarcity on the market, which means demand will only grow.

How to Use Whale Tracking Tools

There are many services that provide on-chain analysis services, with which you can track whale deals. Let's look at the main ones.

How to Use Arbitragescanner

ArbitrageScanner is the best service for on-chain analysis. No other service can compare with the number of tools provided for earning on cryptocurrencies, which makes ArbitrageScanner a market leader.

To track crypto whale deals, ArbitrageScanner provides several tools:

-

Wallet Analysis. This tool allows you to get all available public information about a specific address;

-

Mass Wallet Analysis. Enter several addresses, and you will get all known information: existence of similar tokens, which coins were purchased recently, and whether these wallets interact with DEX;

-

Ready-made Wallet Collections from ArbitrageScanner. If you have no experience in finding wallets, you can use the already prepared collections from the service: they feature addresses of venture investment funds and large corporations;

-

AI Wallet Search. An innovative opportunity to find addresses using one or more other wallets. The neural network uses 512 criteria for searching, which allows it to find exactly those addresses that are most similar to the existing ones. This tool is often used to find insiders and copy trades after them.

Using the presented tools, ArbitrageScanner users regularly find crypto whale deals, copy them, and increase their own deposits. Such a number of useful tools for investment cannot be found in any other service – that is why ArbitrageScanner is so valued by users.

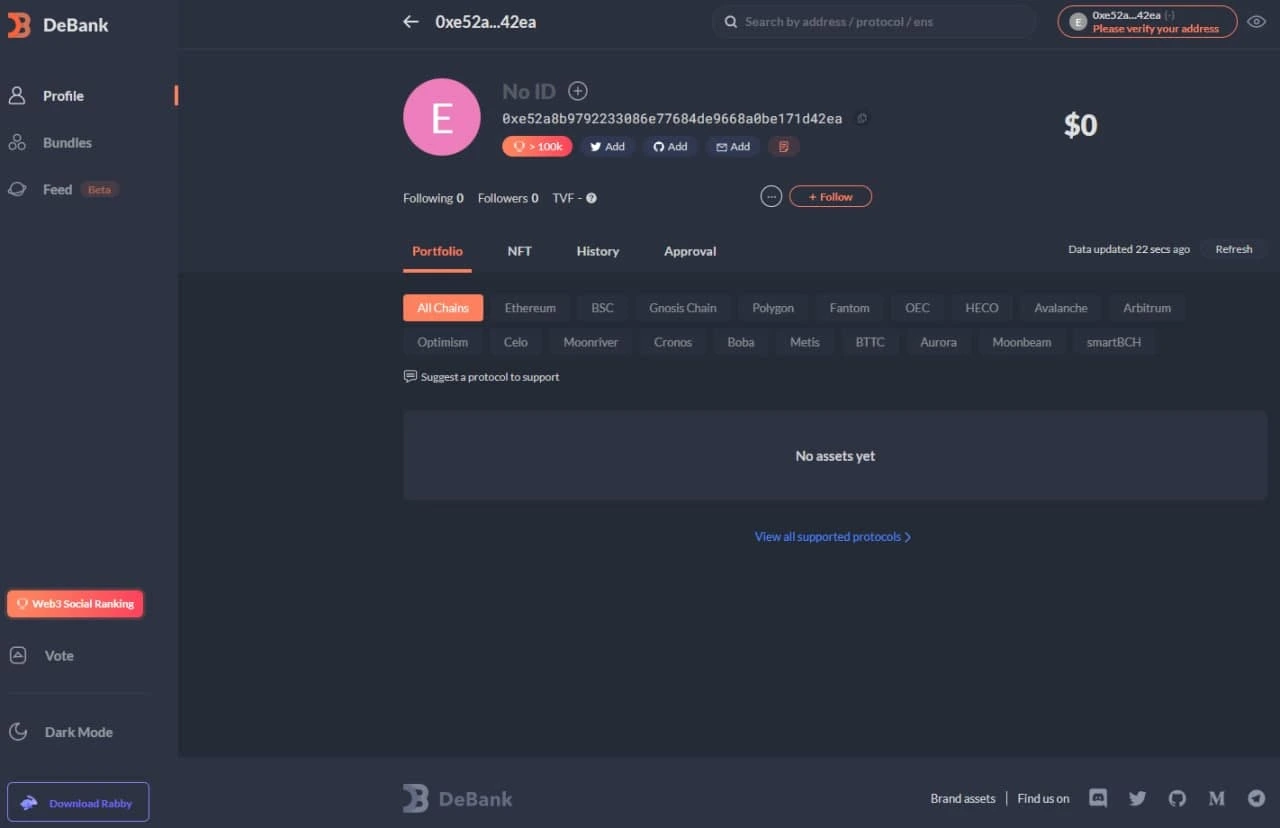

How to Use DeBank

DeBank is an analytical platform that allows for detailed tracking of crypto wallet activity in the field of decentralized finance. The service is particularly useful for studying others' portfolios, assessing the investment strategy of large players, and understanding how liquidity moves between DeFi protocols.

Unlike Nansen, which focuses on "smart" wallets and trends in Ethereum, DeBank is focused on multi-chain analytics and gives a broader overview of the DeFi platforms an address interacts with. This allows for monitoring the entire ecosystem and quickly determining where and how a user's assets are engaged.

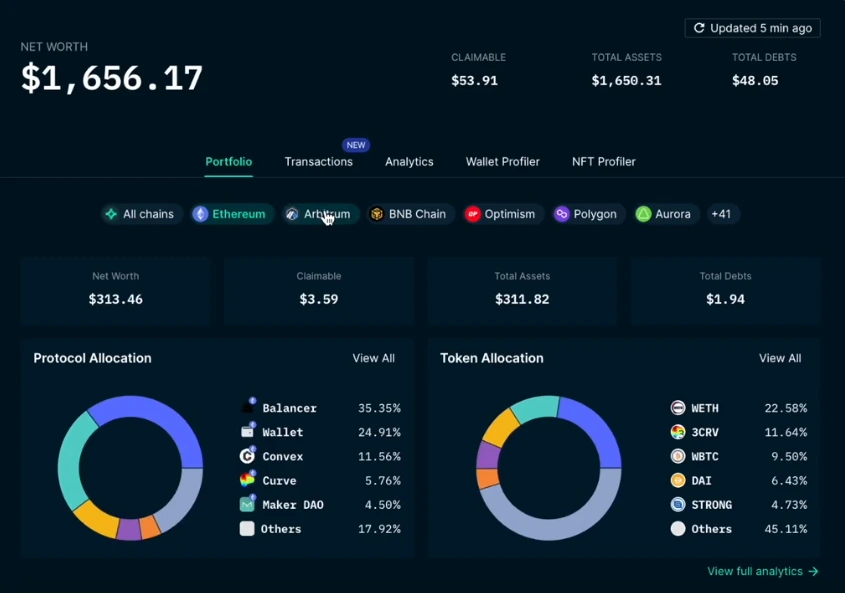

How to Use Nansen

Nansen – an analytical tool for tracking tokens and large cryptocurrency holders

The Nansen platform allows users to track the activity of both individual tokens and so-called whales – large players in the market – in real-time. One of the service's main tools is the Smart Money function, which is an analytical selection of thousands of wallets in the Ethereum network demonstrating the best yields in various areas.

Wallets labeled Smart Money are addresses that have historically shown high efficiency in certain actions: whether providing liquidity, trading on decentralized exchanges (DEX), participating in NFT projects, mining, and much more. Each such wallet is assigned a corresponding tag based on its activity and profitability.

Nansen also provides aggregate analytics on the "smart money" segment: you can find out which assets these addresses are buying, holding, or selling, as well as see which wallets showed the highest returns over various time intervals. This helps identify trends and potential entry points.

Conclusion

Monitoring the actions of crypto whales is one of the most important tools for any investor seeking to understand the real state of affairs in the market. Unlike technical analysis or reading news, on-chain analytics allows for tracking how large capitals move, and this often gives an early signal about upcoming market movements.

Arbitrage Scanner clients, thanks to on-chain analysis, gain access to powerful analytics that were previously available only to professional market participants. With its help, one can not only track large transactions but also build logical connections between wallets, understand the motivation behind the actions of large holders, and, most importantly, make more informed investment decisions. Hurry to join the team and become one of those who can find the coveted "gem."

However, despite all the benefits, it is important to remember: the actions of crypto whales are not always a guide to action. They can make mistakes, participate in manipulations, or promote scam tokens. Therefore, it is best to use their behavior as an additional source of information, combining it with personal analysis, fundamental data, and common sense.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.