On-Chain Analysis of Cryptocurrencies: A Complete Guide

with ArbitrageScanner!

On-chain cryptocurrency analysis: what it is and how to use it?

To profit from trading and investment, it is necessary to regularly perform market analysis of assets that can generate this profit. In traditional financial markets, two types of analysis are used: fundamental and technical. While technical analysis is applied to the crypto market in the same way as in traditional ones, things are a bit more complicated with fundamental analysis: projects that issue cryptocurrencies often do not provide sufficient information about the company as a whole.

However, the crypto market has its own type of analysis that can be compared to fundamental analysis, called on-chain analysis. In this article, we will break down in detail what it is, what information it gives to traders, what metrics and data are used, and look at the top platforms that provide tools for on-chain analysis. For additional practical examples and case studies, see the Tutorials/Cases section.

What is on-chain analysis?

From English, "On-chain" translates as "Inside the chain," and cryptocurrency analysis received this name for a reason. The fact is that all cryptocurrencies function thanks to blockchain technology, inside which data is stored according to the "chain of blocks" principle: a new block is created, into which miners add new data (cryptocurrency transfers, transaction tracking, the number of coins at a specific address, etc.). Information that has been added to the blockchain cannot be modified or deleted in any way – it remains there forever in its original form.

That is why on-chain analysis got its name: with its help, you can analyze the blockchain and obtain a wealth of useful data that will help determine a future trading or investment strategy. On-chain analysis shows the dynamics of supply and demand for a specific cryptocurrency, investor sentiment, and the strength or weakness of a trend. Additionally, use Sentiment Analysis for a comprehensive assessment of market moods. Furthermore, the search can be segmented, for example, by the number of coins on the wallet balance, the activity of holders and miners, accumulation periods, and other criteria.

On-chain vs. fundamental analysis

As already mentioned, fundamental analysis is problematic for crypto projects due to the small amount of information provided by them. However, with the development of the crypto market, such criteria have appeared, and with their help, a small fundamental analysis of a project can be conducted.

-

Development team. Since the crypto industry has existed for more than 10 years, developers who have worked in different projects are not uncommon. In addition, specialists from other industries often enter the industry where they showed good results. It is this background that allows for a small assessment of the prospects of a crypto project. For example – Silvio Micali: once a famous Italian computer scientist, a professor at MIT, who created Algorand;

-

Partnerships. Here we are talking about partnerships with traditional companies. Let's take Ripple as an example: the project has many partnerships with companies from the financial sector, the most famous of which is Bank of America. A company of this level will not enter into partnerships with mediocre projects. This example might be a bit high-end, but the essence does not change from the level of the company, as long as it is in good standing in its sector;

-

Investment from famous funds. a16z, Jump Crypto, Dragonfly, and others are funds that invest in promising crypto projects. In theory, you can simply copy their trades, as they have many analysts on staff who have reached a common conclusion on a project;

-

Idea or product. What matters is what the project offers to the crypto community. If it is an idea that has been "chewed over" several times, which has either already been implemented or abandoned, the probability of it "shooting up" tends to zero. Worthy crypto projects that bring a new vision or product to the masses are still appearing on the crypto market – they are definitely worth paying attention to.

Main on-chain metrics of cryptocurrencies

It should be clarified that the interpretation of on-chain analysis depends on the project. For automated analysis of various projects, use the Crypto API, which provides access to current blockchain data. For example, the analysis of a cryptocurrency from the decentralized finance segment and a meme token will be completely different: what is important in the first case is completely irrelevant in the second. However, there are a number of indicators whose data are useful in the analysis of any cryptocurrency.

Active addresses

If a project has a large and active audience, this will be visible by the number of addresses: these are wallets that hold the project's coins. The more of them, the better, but their number must be confirmed by activity. There have been cases when new projects independently sent their tokens to hundreds or even thousands of addresses to create the appearance of a large number of holders. But if you look at their activity, it becomes clear that these are just "dead souls" where tokens were sent once and no actions are occurring with them.

Number of transactions in the network

This indicator confirms the first one – the greater the number of transactions in the network, the more in demand the coin is. In theory, this data can also be artificially "inflated," but it is much harder, or rather more expensive, than in the first case. A fee must be paid for each transaction, and if the blockchain is not of their own design, artificial transaction inflation will cost the project creators a large sum. One way or another, it is technically possible, so active addresses and the number of transactions in the network are indicators that confirm each other.

Hashrate

Hashrate shows the total computing power of the equipment used to maintain the blockchain's operation, i.e., in mining and transaction confirmation. Data on the indicator speaks to how interested miners are in mining this coin at the moment, as well as how decentralized it is. In general, by hashrate alone, one can understand how a cryptocurrency is doing: if there are many miners, then there are many transactions in the network, and therefore many active users, and vice versa.

Exchange reserve balance: an important on-chain metric

In the news feeds, you can regularly notice that there is more of some cryptocurrency on an exchange, and less of another. The exchange reserve balance is responsible for exactly this: with its help, you can find out what amount of cryptocurrency is represented today on centralized exchanges. Interpreting it is simple: the more coins on the exchanges, the more their holders have a desire to sell the cryptocurrency.

This is a series of basic indicators that are suitable for any cryptocurrency. In fact, there are a huge number of them, and for cryptocurrencies from a certain segment, there are individual indicators. For example, Total Value Locked (TVL) – an indicator that shows the amount of locked value in smart contracts and decentralized applications. It is used to analyze cryptocurrencies from the DeFi segment.

Platforms for on-chain cryptocurrency analysis

Arbitragescanner.io

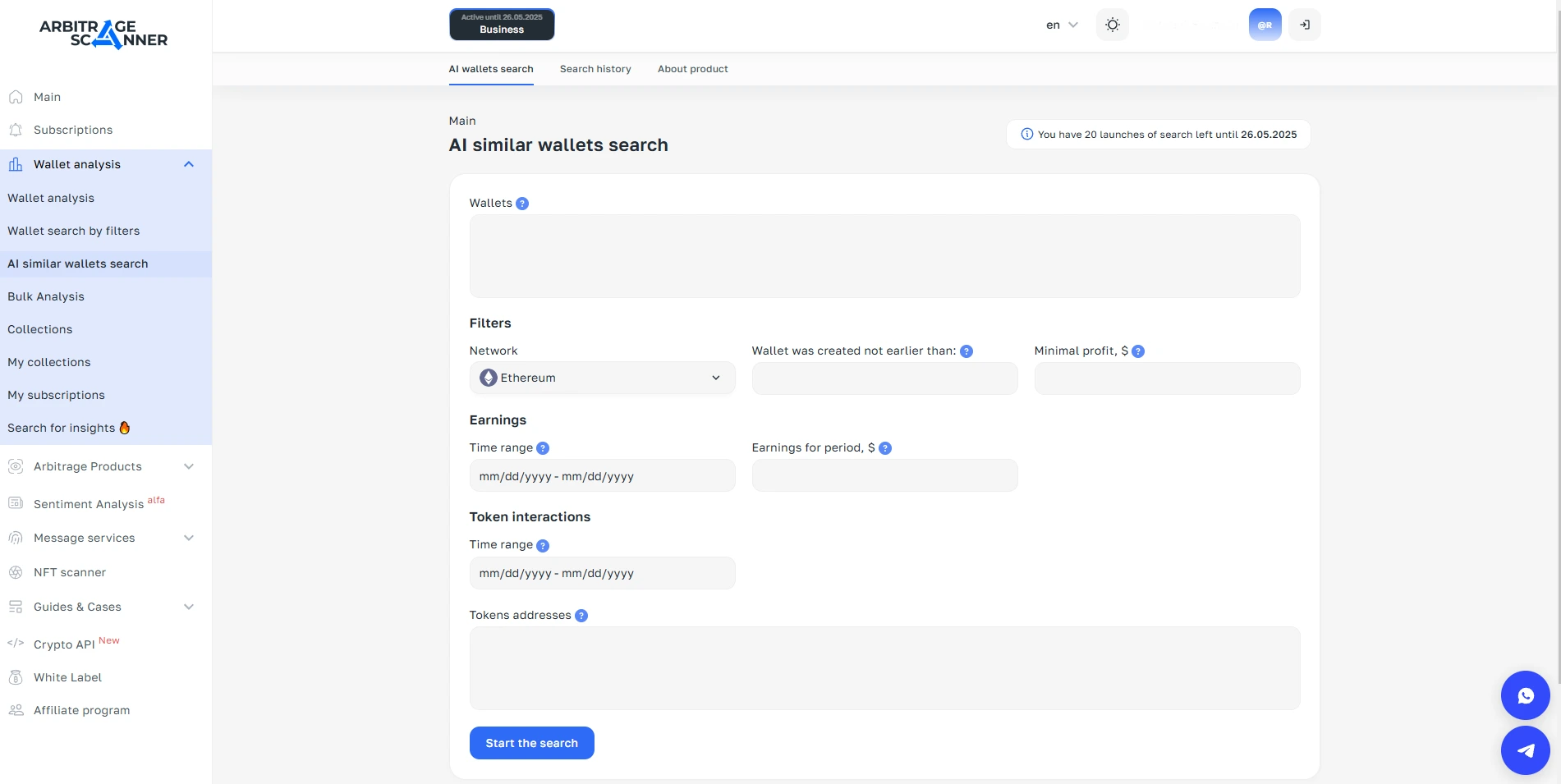

Arbitragescanner.io is a specialized bot equipped with powerful tools for blockchain analysis. It allows you not only to deeply research cryptocurrency wallets known to you but also to find new addresses based on specified criteria. The platform's main functions include:

-

Wallet analysis. By entering an address, you get the full volume of open data: asset balance, transaction history, and interaction with other users. Use the Wallet Analysis function for a detailed study of any address. For example, if you have the address of the official wallet of a crypto project, you can monitor its activity. If the developers start moving tokens that are supposed to remain untouched, this could be an alarm signal, and you should consider selling to avoid losses;

-

AI wallet search. A unique function that is hard to find in similar services. The AI Assistant independently analyzes your input data and selects related wallets. The neural network independently analyzes your input data and selects related wallets. This is especially useful in new projects where the asset price can be controlled by whales – large token holders. The addresses of these wallets are often publicly available, and by using AI, you can form a selection of active market participants and follow their actions;

-

Search for wallets by filters. If you don't have a specific address but want to monitor the activity of a specific token, this function will be useful. You can set filters: blockchain, transaction volume, time frames, ROI, and Winrate indicators. This allows you to form an extensive database, and also use ready-made lists, for example, with addresses of cryptocurrency investment funds;

-

Bulk wallet analysis. The function allows you to process several addresses at once, obtaining data on transactions, interactions with decentralized exchanges (DEX), and showing a list of stored cryptocurrencies.

A nice bonus – the bot does not require an API connection, which makes it more secure. Many find this approach inconvenient, but the absence of an API reduces the risk of funds being stolen by malicious actors.

Dune

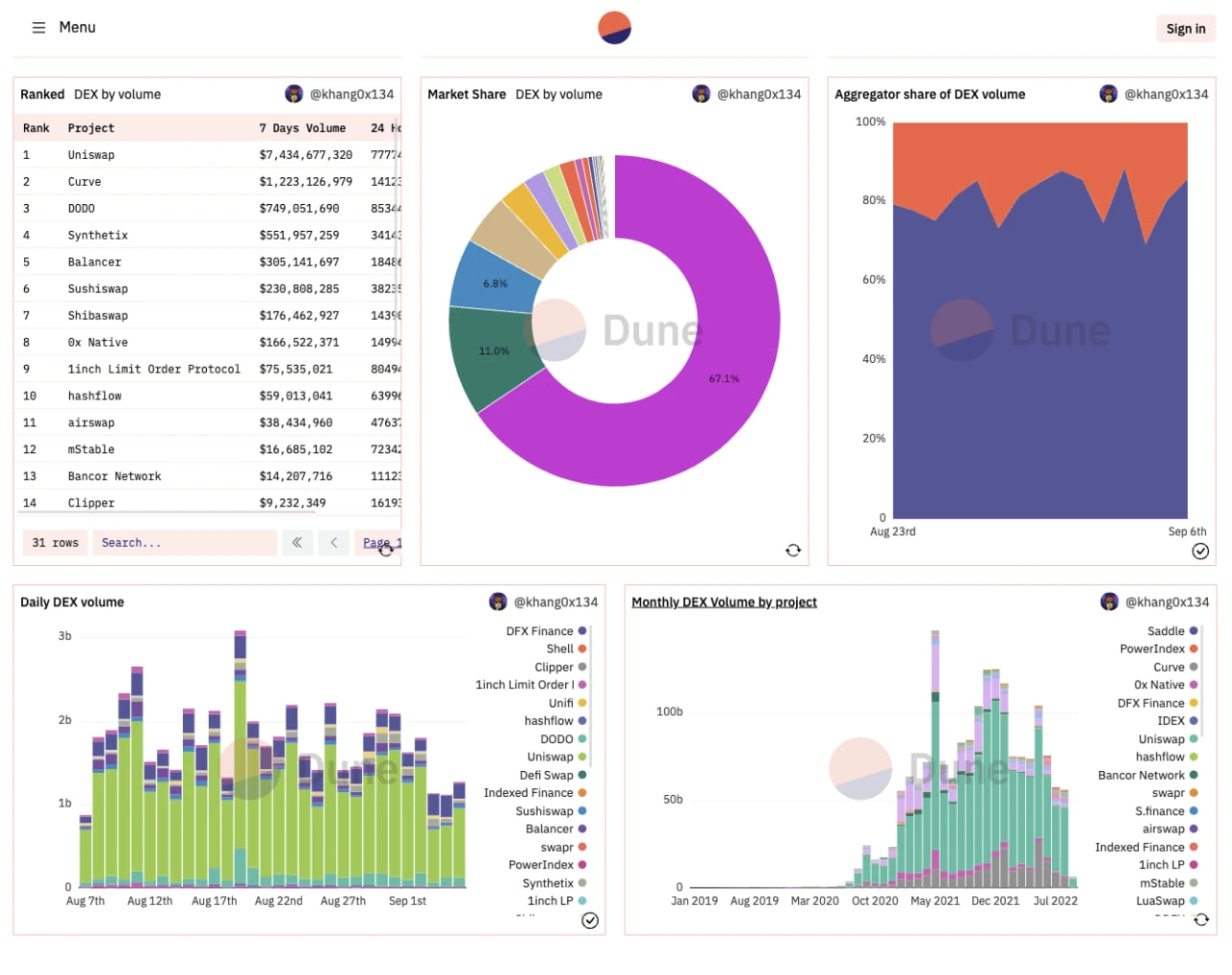

This analytical service specializes in creating dashboards that are formed thanks to the user community. Active participants of the platform, called "wizards," collect and process blockchain data, turning them into visual graphs and reports. Their level of expertise is evaluated in the form of stars attached to each material they create. The higher the wizard's rating, the more trust their data receives from platform users.

With Dune, you can, for example, track the dynamics of gas prices in the Ethereum network, user activity in the DeFi sector, and study the analytics of NFT projects. Navigation on the platform is simplified thanks to convenient filters that allow you to sort dashboards by various criteria: by specific blockchain, popularity, date added, or personal preferences.

One of the platform's disadvantages is the lack of real-time updates. Each dashboard indicates when the data was last updated, and if the information is outdated, you will have to wait several hours for the system to load new indicators.

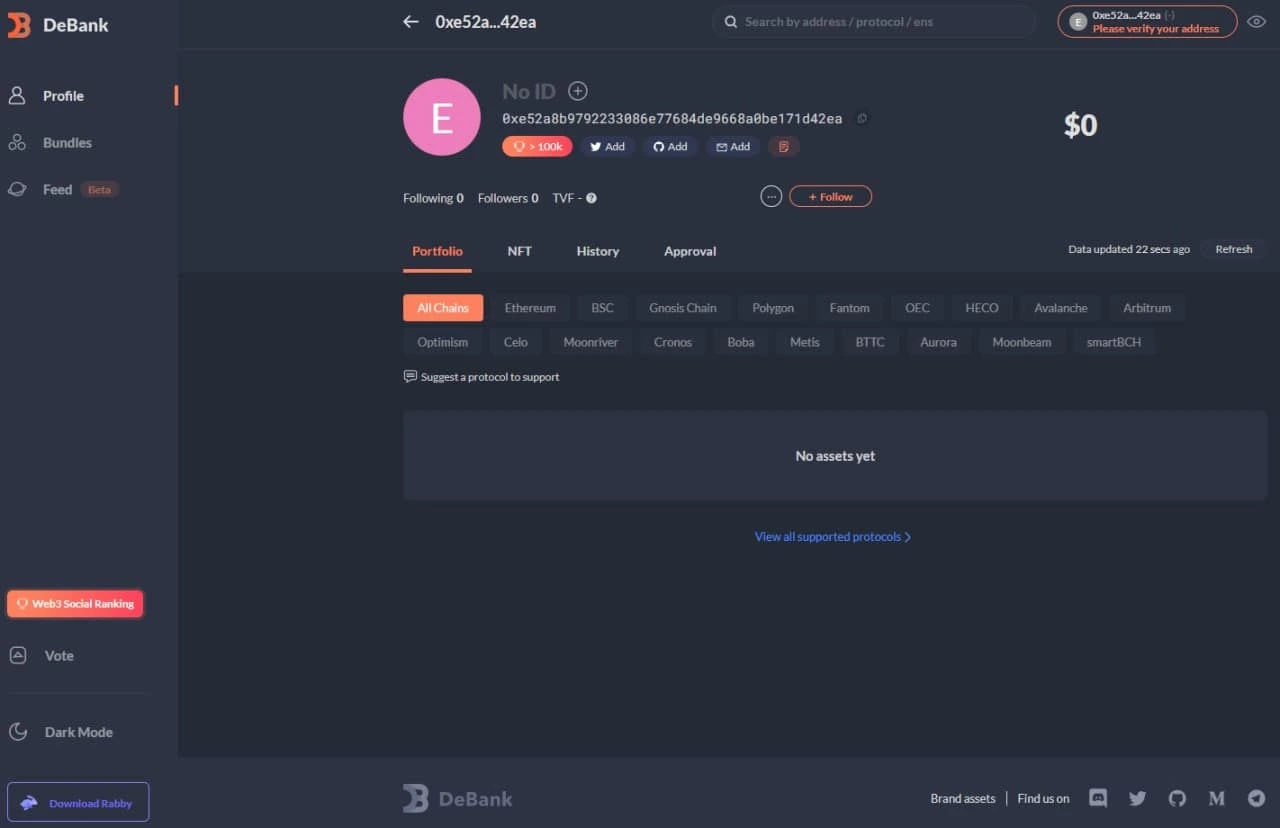

DeBank

DeBank is a Web3 platform that combines a messenger and a cryptocurrency portfolio tracker, and also offers some analytical tools.

The service provides the opportunity to track the activity of whales – large cryptocurrency holders. Also, here you can analyze DeFi protocols by tracking the movement of funds within them. This function is not unique and is found in many similar services.

DeBank also includes NFT analysis – information about the floor price of a token, trading volumes, number of owners, and other parameters. You can filter data by blockchains.

An additional function is the creation of lists of tracked wallets. However, there is a limitation: no more than 5 lists of 10 wallets each. This is not very convenient for those who want to analyze large volumes of data.

Despite numerous positive reviews about the platform, its functionality can hardly be called unique. Nowadays, almost any service offers real-time portfolio monitoring, but the question arises – is it really that necessary? Large amounts are more securely stored on cold wallets, and constant monitoring of hot wallets is not always justified.

How does on-chain analytics help in trading?

Let's look at the example of the main indicators of on-chain analysis:

-

The more addresses hold a cryptocurrency, the more likely its price will grow. If the number of wallets decreases, then investors have stopped believing in its prospects and are selling the coin;

-

The more cryptocurrency on centralized exchanges, the higher the desire of investors to sell it. Conversely, if they withdraw the coin from platforms to wallets, the belief in further growth remains;

-

The demand for a cryptocurrency depends on a high number of transactions and hashrate. If there is not enough power, transactions will be processed for a long time – blockchain users will not be satisfied with this. Again, if there are not enough users in the network, miners will not stay in it for long, as earnings will be minimal. These are interconnected indicators, by the growth of which one can determine how much a certain cryptocurrency is in demand today.

FAQ

Can on-chain analysis be used separately from other analysis methods?

On-chain analysis is a powerful tool, but for the most accurate forecasts, it is better to combine it with technical and fundamental analysis. This will help account for both market trends and behavioral factors.

Which on-chain metrics are considered the most important?

There is no single main indicator – it all depends on the specific asset. However, the number of active addresses, transaction volume, and the movement of coins on exchanges often have a significant impact on price dynamics.

Can you predict a price increase or decrease using on-chain metrics?

On-chain analysis allows you to identify trends but does not give a 100% guarantee of a forecast. Using several indicators together increases the accuracy of the analysis.

Which platforms are best suited for on-chain analysis?

Popular platforms include Arbitragescanner.io, Dune, DeBank, as well as Glassnode and Nansen. The choice depends on the tasks of the trader or investor.

Can on-chain analysis be used for short-term trading?

Yes, but mainly on-chain data is more suitable for medium- and long-term analysis, as it reflects general trends rather than short-term market fluctuations.

Conclusion

On-chain analysis is a valuable tool for studying the cryptocurrency market, allowing for a deeper understanding of investor behavior, network activity, and possible price movements. Unlike traditional fundamental analysis, it uses data stored directly on the blockchain, making it more transparent and reliable.

Arbitrage Scanner helps traders and investors identify key metrics, including indicators such as active addresses, transaction volume, hashrate, and exchange reserve balance, helping to assess supply and demand, which is important when making trading decisions. However, it is important to remember that on-chain analysis is most effective in combination with other analysis methods, such as technical and fundamental.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.