P2P Arbitrage opportunities on Binance: What They Are and How to Find Them

with ArbitrageScanner!

Arbitrage of cryptocurrencies on Binance: Definition and Features

Arbitrage of cryptocurrencies on Binance is a trading strategy based on exploiting price differences between cryptocurrency prices. Binance's high liquidity and wide selection of trading pairs make it an attractive platform for intra-exchange arbitrage. However, traders must consider fees, quick reaction times to price changes, and market fluctuations risks.

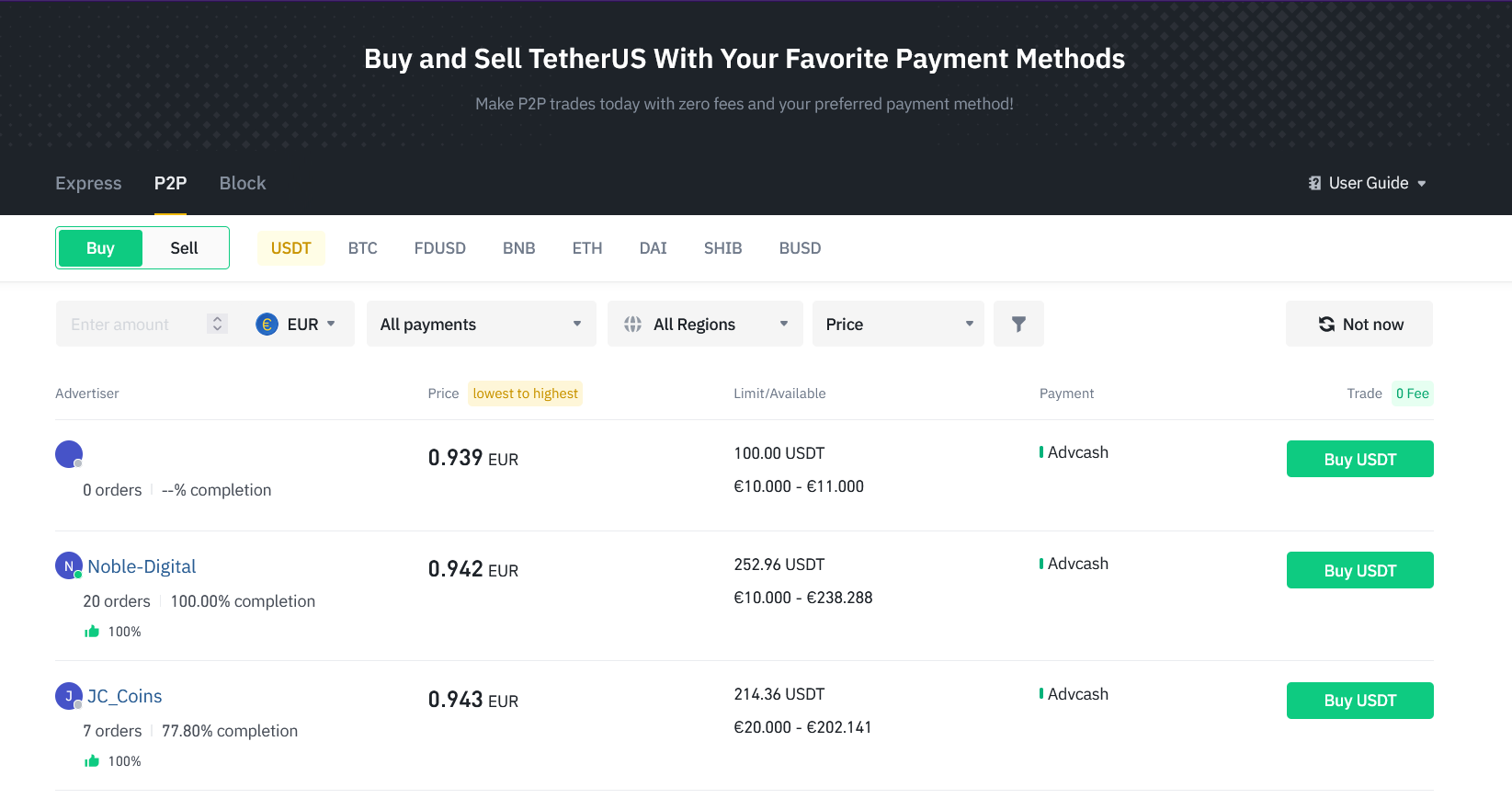

What is P2P Arbitrage and How Does it Differ from Regular Cryptocurrency Arbitrage?

Simply put, P2P Arbitrage involves buying or selling an asset to or from another person. Exchanges are still used in the same way.

Features of Arbitrage on Binance:

- Binance is one of the largest and most liquid cryptocurrency exchanges in the world. This enables traders to quickly execute orders and conduct arbitrage operations with minimal delays as there are a vast number of buy and sell orders available.

- There are a large number of trading pairs with different cryptocurrencies, enabling traders to seek profitable differences in prices.

- Binance only charges commission to market makers on p2p trades. This allows traders to reduce costs and increase overall profits when executing arbitrage operations.

- There is a convenient API for p2p traders, allowing for the automation of intra-exchange arbitrage using trading bots. This increases the efficiency and accuracy of operations, as well as allows traders to respond faster to market conditions.

- Binance is an international exchange that serves traders from around the world. This provides access to the global cryptocurrency market and enables arbitrage operations with different currencies, including fiat. However, p2p market commissions on fiat are 0.35% for USD, and 10% for RUB, KZT, UAH, and 0% for EUR and GBP.

How to Find Arbitrage Pairs on Binance

There are two types of P2P Arbitrage pairs: constant and momentary.

- Constant pairs occur throughout the day, but have a spread of 1-2%, which is practically negligible.

- Momentary pairs occur in response to particular events, causing traders to react, and the spread may reach up to 20%.

Here are several ways to find pairs:

- Start by tracking the market yourself. However, note that catching cryptocurrency spreads can be challenging. For this reason, many traders employ arbitrage bots or programs, which automatically track cryptocurrency price differences.

- In addition, another way to find pairs is to seek information in chats and channels where arbitrage cases or hot news, rumors, etc., are published.

We are currently testing a new product for finding such insider or “hot” information, called the Telegram Scanner. You can connect to all information channels and track mentions of any cryptocurrency you need with keyword searches. All this information will be forwarded to you in a separate chat, where you can quickly process information, answer questions, or join discussions from the chat where the message was posted. But, the most important thing is to be one of the first to receive information about upcoming events.

However, P2P arbitrage has become an almost bygone era. Almost all P2P traders use automatic intra-exchange arbitrage bots, which not only pose financial risks for users, as API connects through trading bots, but also arbitrage traders fill the market and create unimaginable competition.

Nevertheless, there are inter-exchange and spot market arbitrage on CEX and DEX exchanges. There are also special tools for such trading.

One such tool is our ArbitrageScanner trading bot, which significantly streamlines pair searches for traders.

For those who want to not only try arbitrage with their currencies or those they plan to invest in, but also have the ability to see all available spreads on different exchanges, we offer our second available product – the Cryptocurrency Arbitrage Screener.

This program allows you to configure a list of exchanges and specify a minimum spread that interests you. You will receive notifications every 15 seconds and will be able to find all pairs that interest you.

We also publish interesting pairs and cases in our own Telegram channel, so don't forget to subscribe and stay informed of the latest news.

Examples of Binance Arbitrage Pairs and Their Key Nuances

Let's consider an example of a constant pair in cryptocurrency arbitrage on P2P markets on Binance.

Suppose 1 BTC is worth 10,000 USDT on Binance, and the USDT to USD exchange rate is 1:1.

- The trader buys 10,000 USDT for 10,000 USD on an exchange.

- The trader buys 1 BTC for 10,000 USDT on the P2P market.

- After purchasing, the trader sells 1 BTC for 10,100 USDT.

- As a result, the trader earns a profit of $100, which is 1%.

If we consider momentary pairs, the mechanism is similar but requires faster action.

What You Need to Get Started

To begin P2P arbitrage on Binance, you will need:

- A verified account (KYC)

- A cryptocurrency wallet for storing funds during arbitrage

- A bank card to purchase fiat and withdraw funds.

Conclusion

P2P cryptocurrency arbitrage on the Binance exchange can be profitable, but there are many difficulties in this path. The advantages of this method include Binance's high liquidity, wide selection of trading pairs, and convenient API. To profit, traders need to find pairs using arbitrage bots and programs or independently search for information in chats or other channels to find opportunities for momentary arbitrage. However, P2P arbitrage is becoming less popular due to competition and the dangers of transmitting API to third-party services.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.