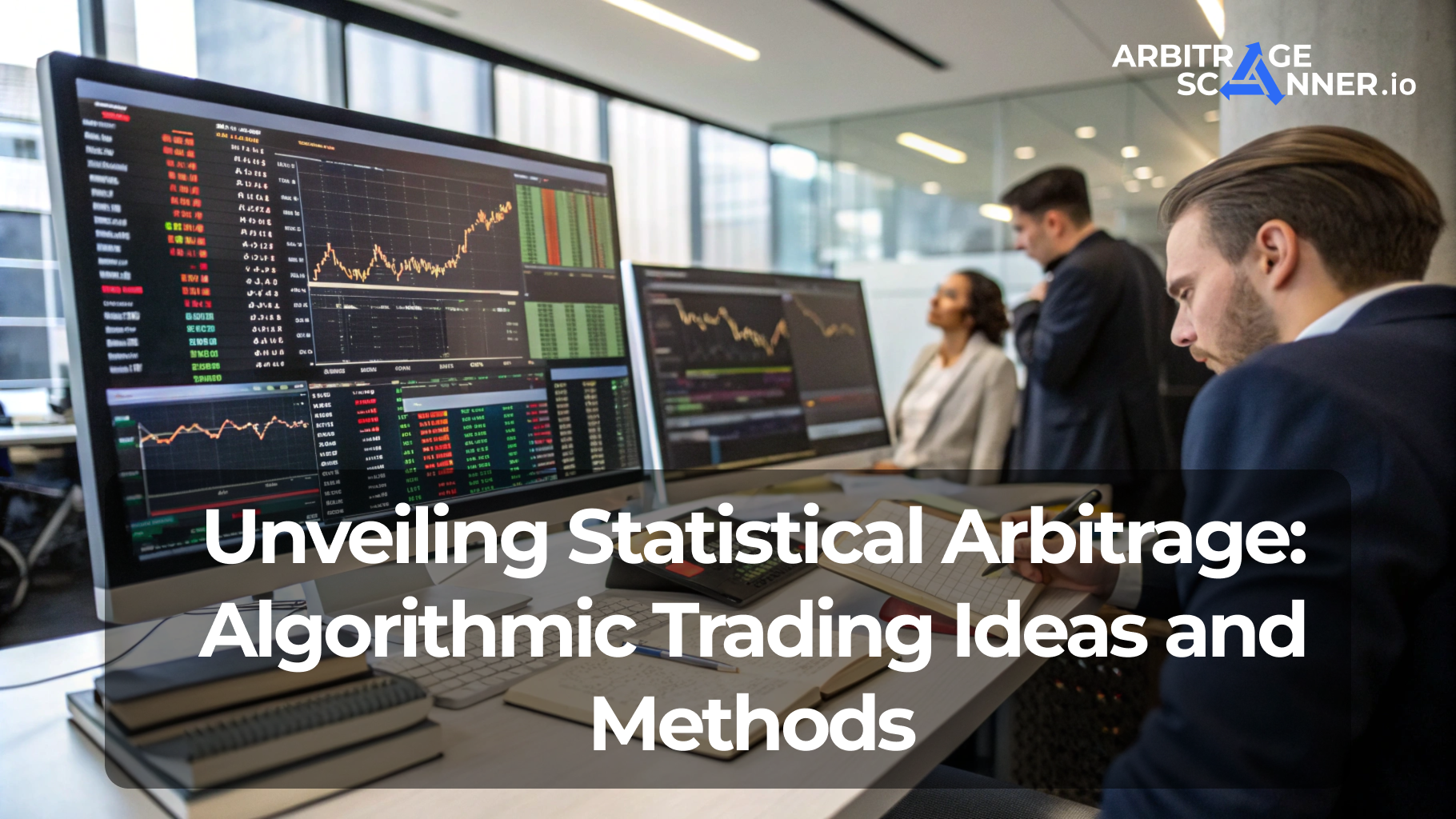

Unveiling statistical arbitrage: Algorithmic trading ideas and methods

with ArbitrageScanner!

Statistical Arbitrage

Statistical arbitrage is a trading strategy that involves temporary price discrepancies of an asset across different platforms, utilizing mathematical and statistical calculations. Arbitrage situations most often occur in the cryptocurrency market due to the inefficiency of modern trading platforms. The service ArbitrageScanner highlights and discusses these situations, offering a variety of tools for cryptocurrency arbitrage.

Statistics play a key role in statistical arbitrage, as quantitative analysis and modeling help traders understand where price discrepancies will occur.

The principle of statistical arbitrage is mean reversion. Arbitrage pairs exist for a certain period, after which the price evens out and the arbitrage opportunity disappears, along with the chance to profit.

Over time, statistical arbitrage began to be implemented through algorithmic trading. This brought about:

-

Speed of transaction execution. The algorithm does not think about whether to perform an action; it operates according to predefined parameters.

-

Analysis of a large volume of information in real-time, allowing adaptation to market conditions and strategy adjustments.

Algorithmic Trading

Algorithmic trading is the process of automated buying and selling of assets on an exchange using special programs. These programs operate according to predefined rules or algorithms, allowing trades to be executed faster and more efficiently than by humans. Algorithms analyze large volumes of data, monitor price movements, and make decisions to buy or sell assets in fractions of a second, helping to generate profits or minimize losses.

One popular algorithmic trading strategy involves buying when the price drops by 5% and selling when it rises by 5% – buying on the dip and selling on the price recovery.

Another algorithmic trading strategy involves splitting one large order into several smaller ones. This is done using special order-splitting algorithms that also process price characteristics and send the order for execution. The main goal is not only to profit from the trade but also to reduce execution costs and the risk of order non-execution, as well as to minimize the impact on market sentiment.

This strategy is well-suited for statistical arbitrage. It is in the arbitrageur's interest for the pair to last as long as possible to continue profiting. Therefore, splitting a large order into several smaller ones helps to:

-

Avoid the rapid obsolescence of pairs;

-

Prevent order non-execution;

-

A large order can influence market participants and the asset price, while several smaller orders may go unnoticed.

Risk Management in Statistical Arbitrage

Essentially, the risks in all types of trading are similar. Here are the main points:

-

There should be a clear percentage that you are willing to allocate to a trade. This percentage should not change based on the classification of assets; it should always be the same;

-

Diversification and risk hedging. Try to distribute your capital across different assets. If these are stocks, choose companies from different sectors: for example, IT and oil companies. Or these could be completely different assets: for example, cryptocurrencies and bonds. The idea is that if there is a downturn in one sector's stock market, it will cast a shadow on the other sectors. This also applies to other assets;

-

Always set a stop-loss to reduce risks. Yes, you may incur small losses when the stop-loss is triggered, but this is better than losing a significant portion of your capital;

-

Determine a loss threshold for the day, week, and month. If you see that you are approaching one of these thresholds, reduce the percentage allocated to each trade or stop trading temporarily;

-

Approach trading, investing, or arbitrage with responsibility: it is not a game or a casino; it is work that needs to be done well to receive worthy compensation for your efforts;

-

The main risk of algorithmic trading is that people entrust their finances to a third party (software developers), and in practice, some unscrupulous market participants steal their clients' assets and disappear.

However, there are a couple of points specifically related to arbitrage risks:

-

When choosing a platform, pay attention to the liquidity of the asset. If the exchange lacks sufficient liquidity for the chosen asset, the order will take a long time to execute, which can lead to no profit or a loss;

-

Operational risk: the speed of fund transfers, commissions, verification for operations – factors that depend on the exchange and are beyond your control.

Conclusion

Statistical arbitrage, supported by algorithmic tools, opens up broad opportunities for traders, offering more precise, fast, and secure ways to profit from temporary price discrepancies. However, despite the automation of processes, risk management and discipline remain key factors for success.

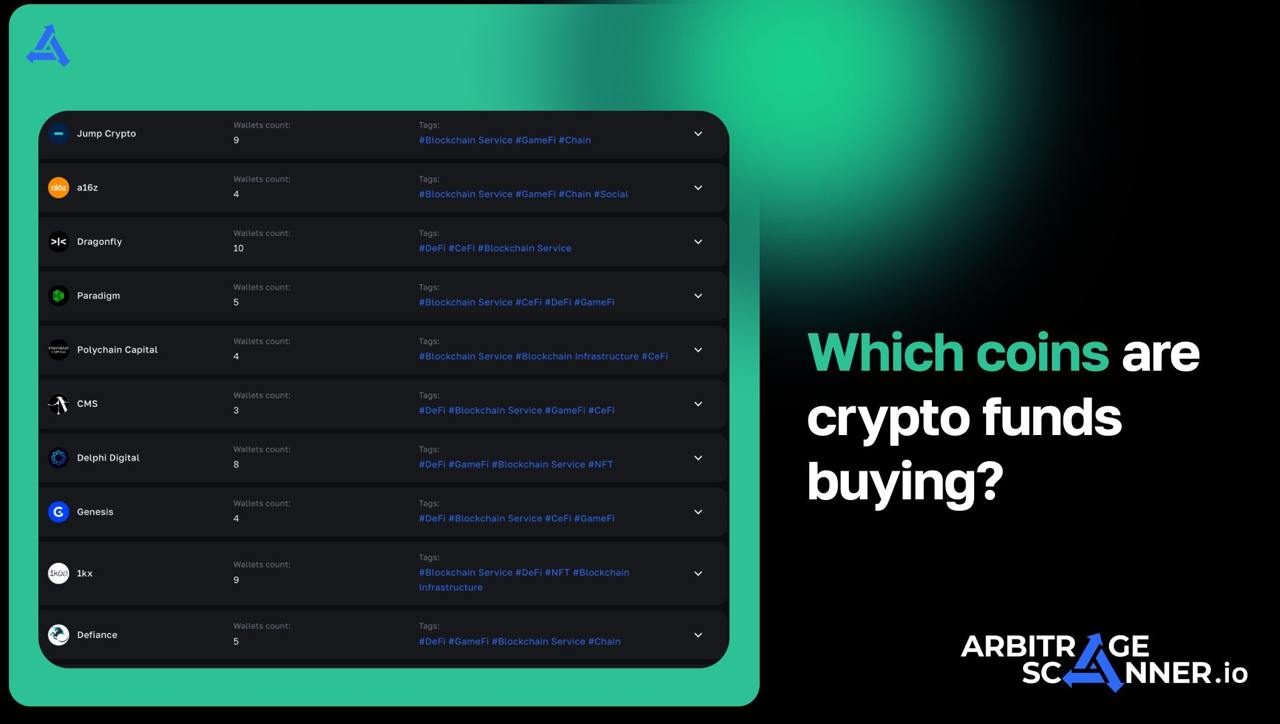

Although ArbitrageScanner uses process automation, control over finances remains with the user, not the service. Therefore, ArbitrageScanner clients are confident about their funds, as they are under their full control. Thanks to the service, you can automate the process of finding arbitrage opportunities and quickly respond to market changes, significantly increasing your chances of profit.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.