Where to look for crypto arbitrage opportunities?

with ArbitrageScanner!

What are crypto arbitrage setups, and where can you hunt them down?

According to CoinMarketCap, the market currently lists over 2.4 million cryptocurrencies — and that’s just the ones officially tracked! There are actually even more out there. Since the crypto market is relatively young (compared to traditional markets), there’s no central authority to determine each coin's value. Instead, prices on any crypto exchange are shaped by supply and demand.

Supply and demand don’t stay the same everywhere, which creates price differences across exchanges: one exchange might list BTC at $50,000, while another has it at $49,997.

This price gap is where crypto arbitrage comes into play. It’s essentially an old-school hustle that predates the crypto world. The goal for a crypto arbitrager? Find a profitable setup: a coin or token that costs less on one exchange than on another. Then, buy low, sell high, and pocket the profit.

The beauty of crypto arbitrage is that it doesn’t care about market moods or the shifting sentiment of traders. You won’t have to switch coins or scramble to adjust your trades based on market direction. Arbitragers only care about one thing: the price gap. Whether the market’s up or down, it’s all the same.

New crypto exchanges (centralized and decentralized) are constantly popping up. With no universal legal framework for crypto, there’s no central authority on digital asset pricing. So, while the opportunity’s here, it’s prime time to dive into crypto arbitrage. And our service is here to make it happen for you.

What’s a crypto arbitrage setup?

An arbitrage setup is a profit-making game plan for crypto moves. Say you have a certain coin and a few exchanges where its price varies — some places it’s higher, others it’s lower. That’s your setup, which you can use to cash in through crypto arbitrage.

There’s arbitrage within a single exchange and between multiple exchanges, with potentially unlimited platforms in the mix. Single-exchange arbitrage is rare these days, since most platforms have bots monitoring assets to close any price gaps as they appear.

There are three main types of inter-exchange setups:

There are three main types of inter-exchange setups:

-

CEX + CEX;

-

DEX + DEX;

- CEX + DEX.

You can find profitable setups between any platforms. Just keep a couple of things in mind about decentralized exchanges (DEXs):

- Trades aren’t instant because your coins move through the blockchain, unlike centralized exchanges (CEXs) where swaps happen instantly if there’s liquidity.

- DEXs operate within a single network. For example, tokens on Uniswap only work on Ethereum, while PancakeSwap runs on BSC, etc.

If you’re new to crypto arbitrage, start with a CEX + CEX setup. Price gaps appear every second, and there are fewer hidden pitfalls.

How to find a working setup in crypto arbitrage?

Start with market analysis. Choose the coins you want to arbitrage and the exchanges where you'll look for arbitrage setups. Keep in mind that some exchanges require KYC to perform trading operations.

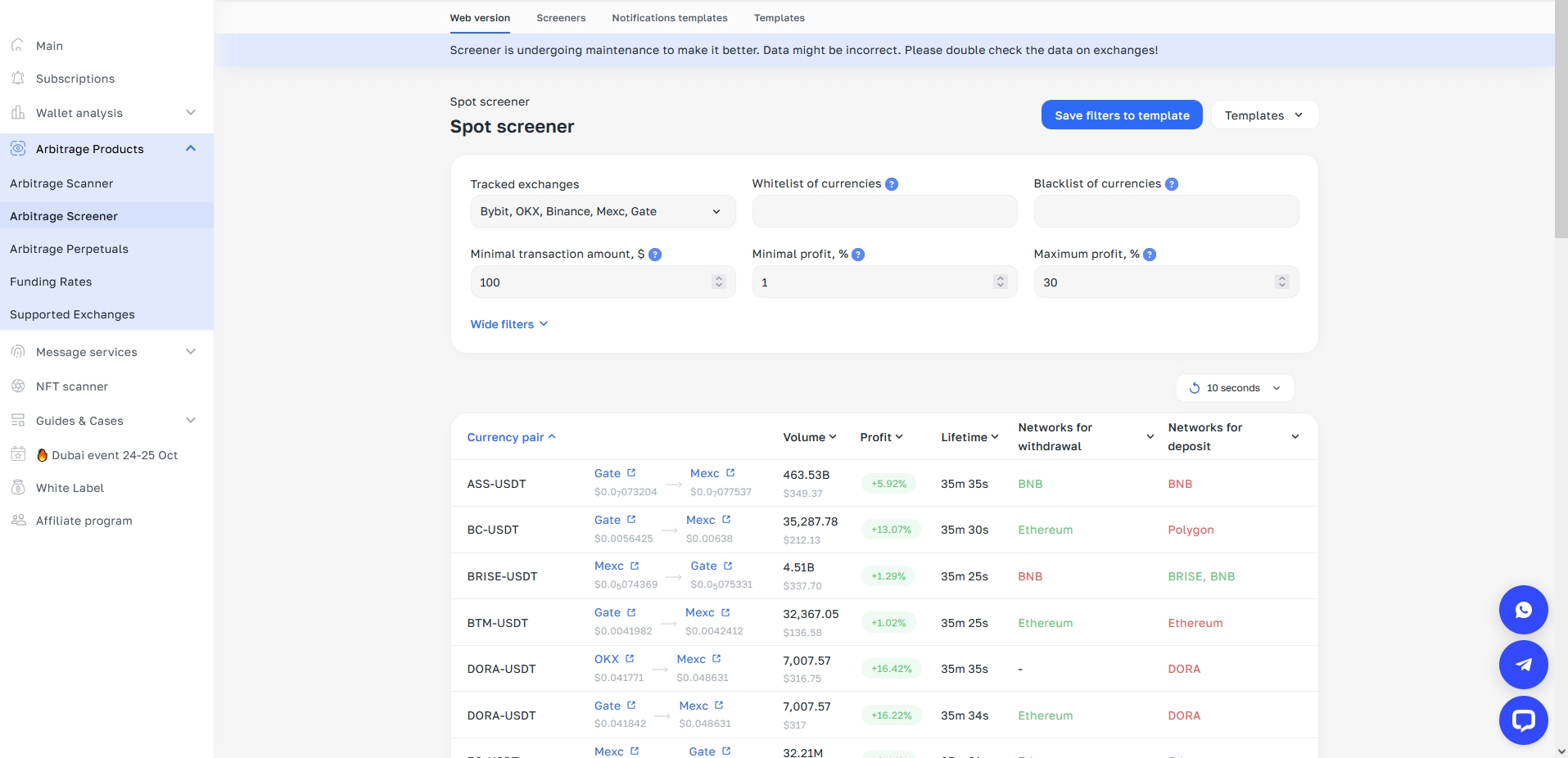

Next, go to an arbitrage screener like Arbitragescanner.io and enter the following information:

- Exchanges to search for setups: You can include more than your initial selections to see how frequently setups appear for your chosen coin.

- Blacklist: Add coins with restricted withdrawals, high transfer fees, or slow blockchains.

- Whitelist: You can use pre-made templates from Arbitragescanner or create your own by adding coins you want setups for.

- Then, set the minimum trade amount, as well as the minimum and maximum profit.

With setup complete, wait about 2-3 days, then review which exchanges had the most arbitrage setups for your chosen cryptocurrency. This approach helps confirm the right asset and lets you choose the best exchanges for arbitrage.

We highly recommend starting by understanding the settings in the arbitrage screener to gain basic experience in this new area.

From the screener's data, pay attention to the setup’s liquidity. For instance, a 10% profit on one cycle may only allow $100 to be moved, but a 3% profit with a $1,000 limit could yield more profit, provided you have the capital.

After a couple of trial runs, your process should look like this:

- Select suitable exchanges;

- Add your crafted whitelist and blacklist;

- Check emerging opportunities for liquidity and deposit/withdrawal options on exchanges;

- Buy, transfer to another exchange, and sell.

The process is simple; you just need to familiarize yourself with the setup filters and create your coin lists upfront.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.