How to profit by tracking market makers

with ArbitrageScanner!

Our subscriber shared a case study detailing how they generated profits using our service’s tools: Wallet Analysis and Collections.

The user analyzed transactions from the market maker Wintermute and identified notable activity: the market maker was transferring tokens to the OKX exchange when the token price was at a local low. After conducting their own analysis, the user recognized a promising opportunity. By taking a position, they achieved a net profit of over $5,096.

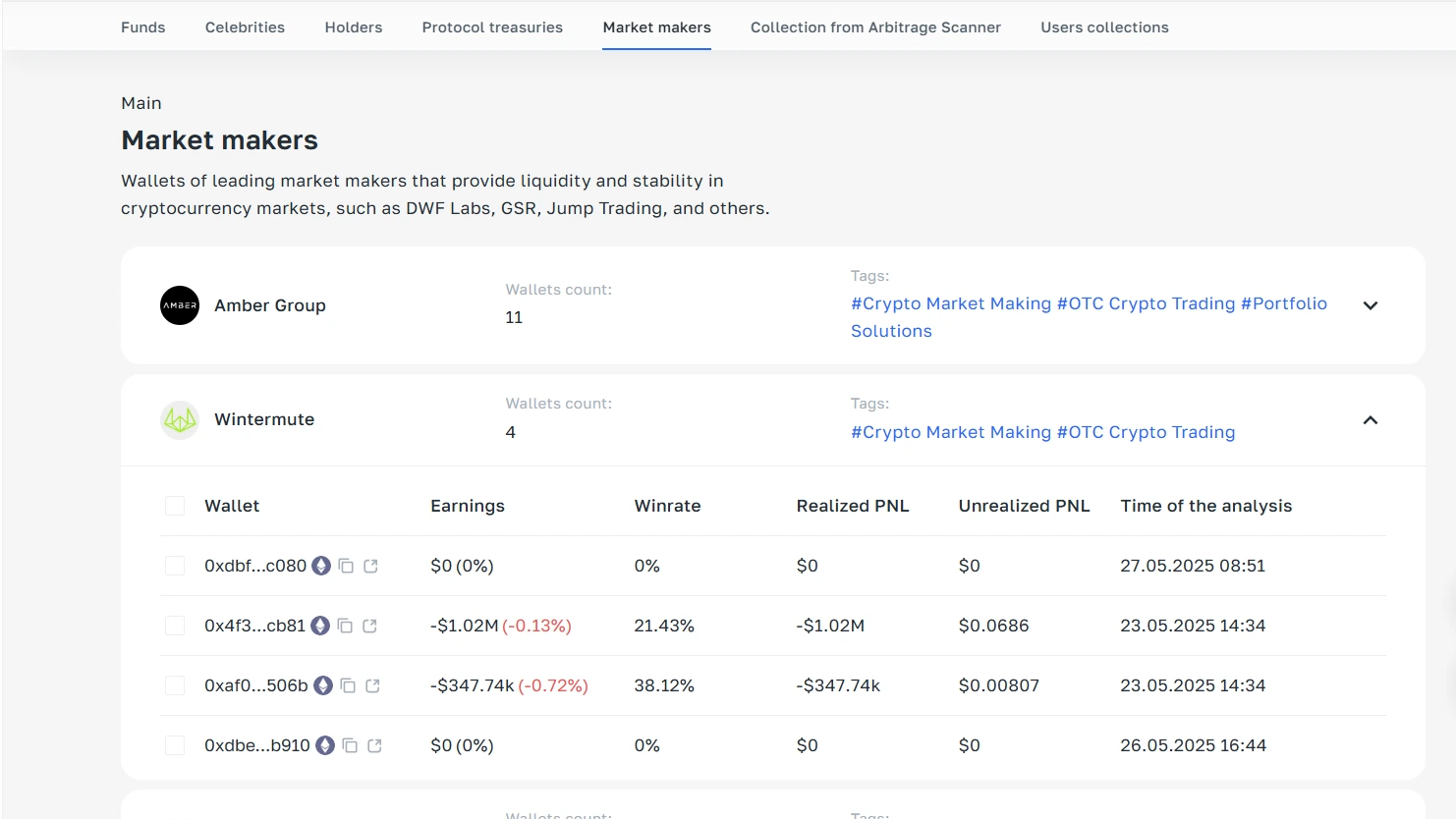

How to identify market maker wallets?

Our subscriber located Wintermute’s wallets using the Collections section of our platform.

Tip:

The Collections section allows you to discover wallets belonging to key market participants, such as funds, market makers, celebrities, and skilled traders.

Subscribers can also share public collections in this section.

All features are accessible in the respective section:

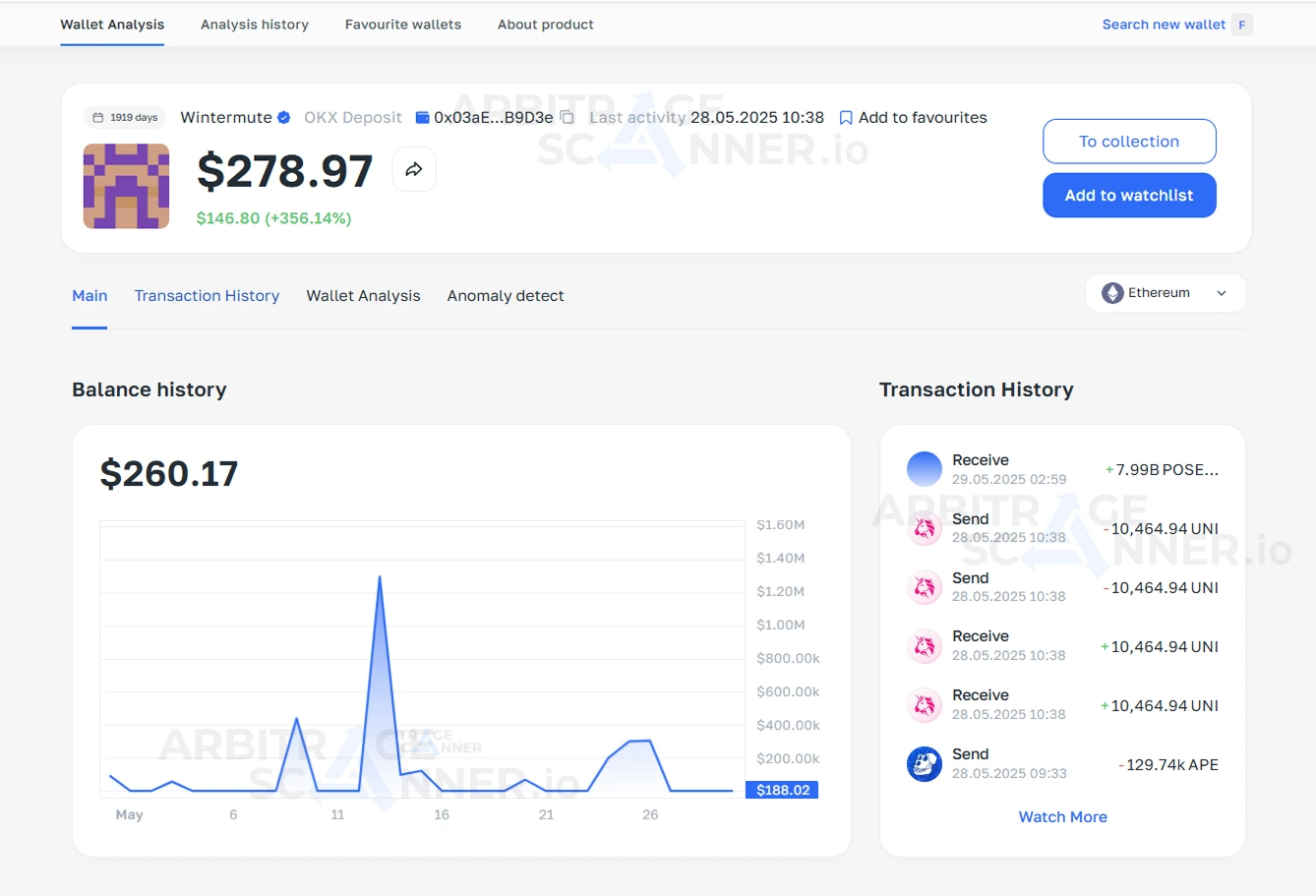

Using the Wallet Analysis tool, the subscriber examined the transaction history to identify behavioral patterns.

Figure 1 - Wallet analysis for address 0x03aE on ArbitrageScanner.io

How to analyze market maker behavior?

The subscriber discovered that the market maker was consistently transferring TRB tokens to a single address. Notably, the transfer volumes were relatively small, averaging $30,000 per transaction, considering the token’s market capitalization of approximately $70 million.

You can independently analyze the transaction history via the provided link.

The receiving address was identified as a deposit wallet for the OKX exchange. The subscriber also reviewed the token’s price chart:

The price was at a local low of around $30, and the user interpreted this activity as a potential setup for price manipulation. They added the token to their portfolio with an investment of $9,800, anticipating a price increase.

How much users earn by analyzing market makers wallets?

Eleven days after the purchase, the token’s price chart showed increased activity, resulting in a 52% price surge.

Figure 4 - TRB token chart after sale

Following the price increase, the subscriber sold the tokens for $14,896, securing a net profit of $5,096.

Through the use of Collections and Wallet Analysis, the subscriber successfully identified Wintermute’s activity and capitalized on it, earning over $5,096 in profit. This example illustrates how on-chain analysis tools can uncover lucrative opportunities.

Adopt this strategy and share your results!

Note: Please exercise caution and approach trading and investments responsibly.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.