How to properly exit the deal Spot + Futures

We have prepared each lesson in text and video format.

In this lesson, I will look at 2 examples of how to close deals correctly.

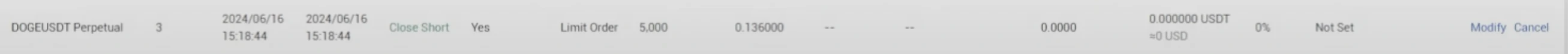

1. DOGE

I entered this deal using the Futures - Futures strategy. We open short (sell) where it is more expensive, open long (buy) where it is cheaper.

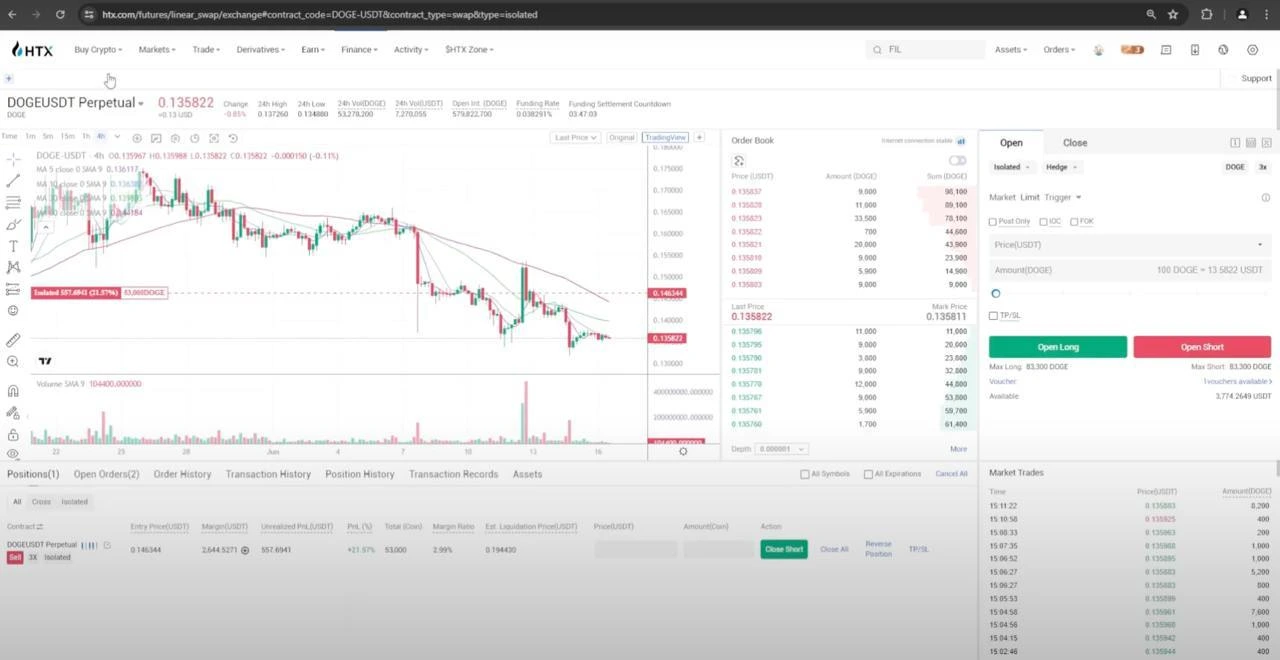

A short position was open on HTX:

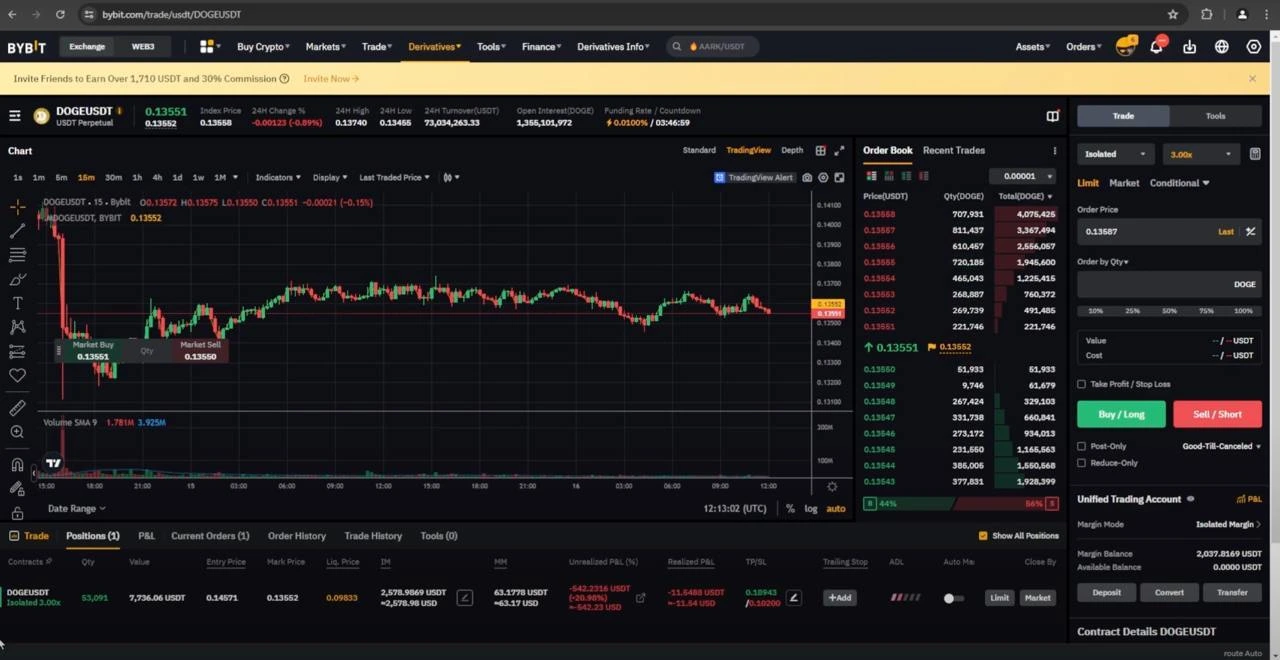

A long position was open on Bybit:

We can use 2 options to close a position:

-

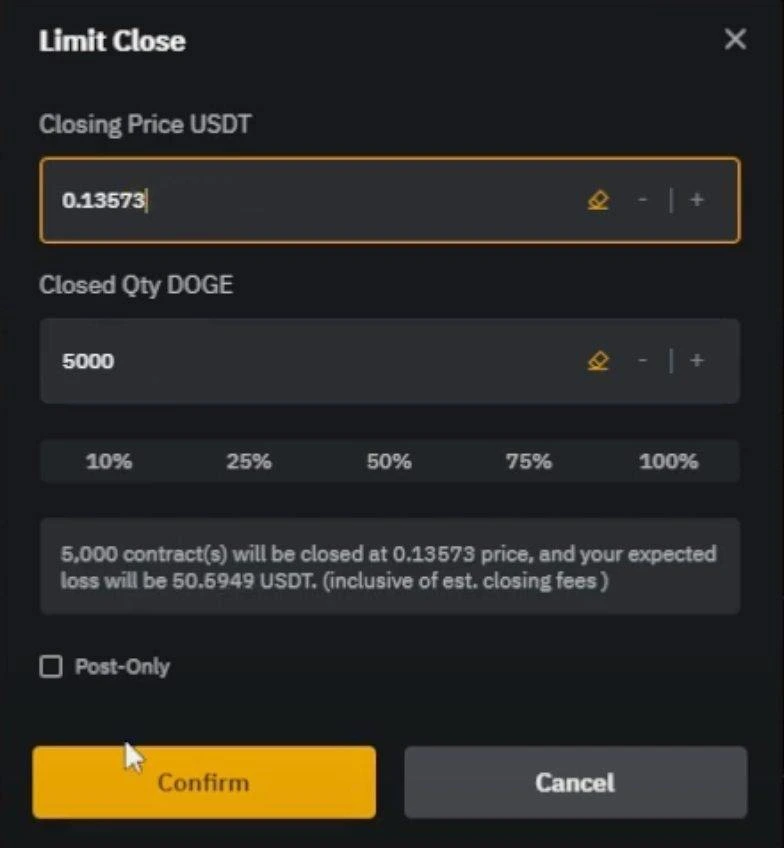

Limit order — an order is placed at the price you need. If you have a long position open, then your order to close will be in the red part of the order book close about warrants in green parts glasses.

With a short position, the opposite is true. -

Closing by market (Market) - your entire position will be closed according to existing orders in the order book. This is significantly less profitable, especially for large positions. Moreover, by selling into the “market” you also pay more commission to the exchange. Then, if they placed limit orders. The main advantage here is speed.

I opened short at a price of $0.146344, long at $0.14571, respectively, the spread at the time of entry was 0.43%. The current spread is 0.2% => on the difference in prices, I will earn 0.23% + charges for the financing rate.

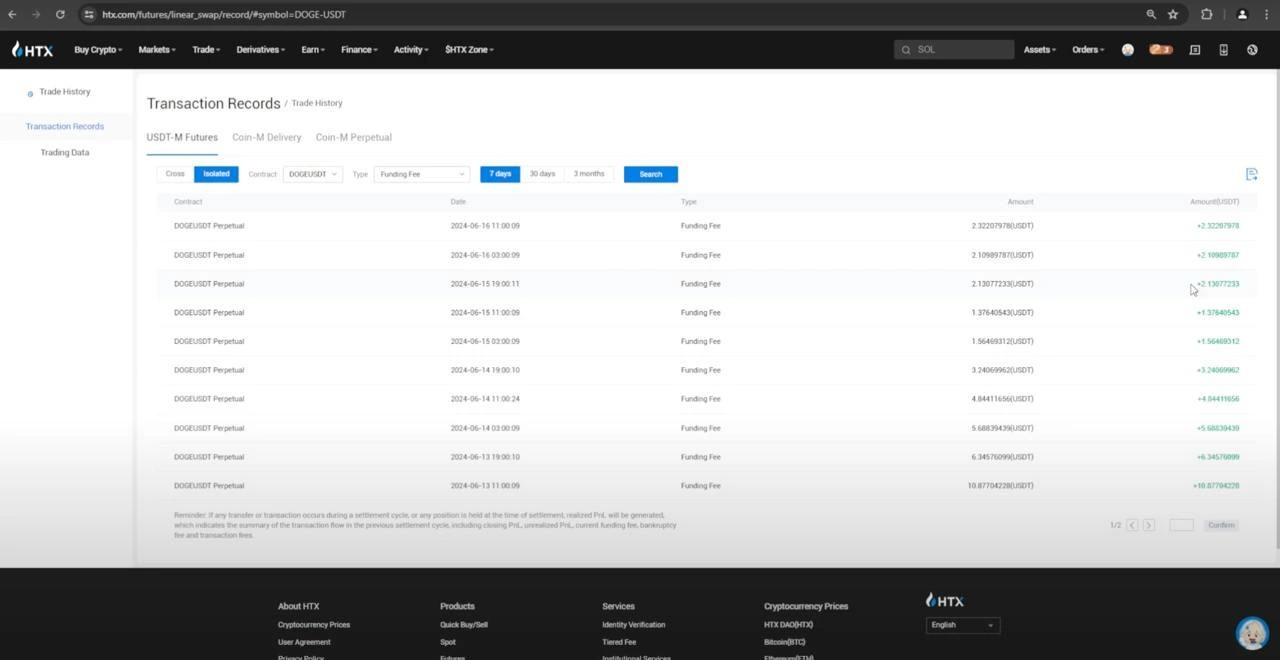

On HTX you can see the charges in the transaction history.

Transaction history => Trade history => USDT-M Futures => Isolated and then select the pair you need and the Trading Fee parameter.

The funding rate gradually decreased and therefore I decided to exit the deal:

We are exiting the deal in parts. I went out for 5000 coins, that is, they closed 5000 coins on one exchange, then closed the same amount on another, and so on for several circles. Initially, I decided to close the position on HTX, since there is less liquidity there.

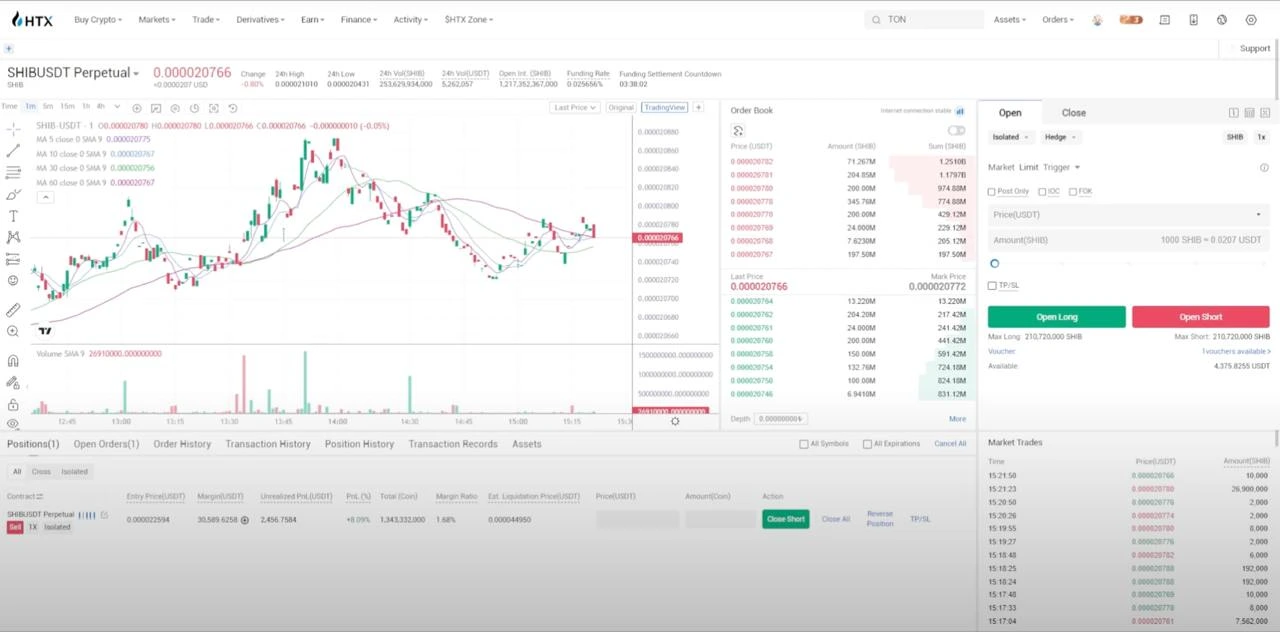

2. SHIB

I entered this trade using the Spot - Futures strategy. We open short (sale) where it is more expensive, we buy on the spot where it is cheaper.

A short position was open on HTX:

I bought tokens on spot Bybit:

I will close the deal with orders of 10%. First of all, I sell on the spot, because the token is falling. However, the price on futures changed for the worse for me, so I decided to close the deal for a market price to avoid additional risks.

Maximize your crypto arbitrage potential!

ArbitrageScanner is not just a service—it's a full-fledged educational platform for crypto arbitrage. We provide access to advanced tools and teach you how to use them effectively.