CoinEx Crypto Exchange: How to Use and Withdraw Funds

CoinEx Overview

Due to the impact of international sanctions and market shifts since 2022, many crypto platforms have exited certain markets. This has significantly affected traders in specific regions, as platforms like Binance were previously dominant. However, this reduction in competition has benefited other exchanges, such as CoinEx.

In this article, we will provide a detailed overview of the exchange: its history, the services it offers, how it ensures the protection of user accounts, and much more.

Brief Description of CoinEx

CoinEx is a cryptocurrency exchange that provides users with the opportunity to trade on the spot market and with perpetual futures. The platform's daily trading volume exceeds $350 million. CoinEx features 1,699 trading pairs, 267 of which are perpetual futures.

The exchange regularly confirms its own reserves; however, this information is only available on the CoinEx website, rather than on services like CoinMarketCap or CoinGecko.

CET Token

CoinEx has a native token called CET, which is used in various exchange processes. It allows users to become VIP members and offers several advantages, namely:

-

Discounts when paying trading fees with CET tokens;

-

Preferential daily interest rates for margin loans;

-

Increased referral commission rates;

-

Free airdrops;

-

Priority customer support;

-

Personal account manager;

-

Access to CoinEx offline events.

To become a CoinEx VIP user, you must hold at least 2,000 CET or 10,000 USDT in your account.

CoinEx History and Statistics

CoinEx was released in 2017 with the support of the mining equipment manufacturer Bitmain. The exchange is part of the ViaBTC Group ecosystem, which also includes the ViaBTC mining pool, the ViaWallet cryptocurrency wallet, and the CoinEx Smart Chain blockchain.

CoinEx Security System

CoinEx stands out among other exchanges for its approach to security. The platform regularly implements new protection mechanisms and conducts security audits to avoid accidental hacks and the loss of client funds.

Components of the Exchange's Security System

Currently, CoinEx offers users the following protection mechanisms:

-

Identity Verification. By confirming their identity, users help CoinEx specialists determine whether an operation was authorized by the account owner or not;

-

Two-Factor Authentication (2FA). A standard mechanism found on many online platforms. Upon login, the system automatically requests a code from Google Authenticator or an SMS message, which refreshes every minute;

-

Secure HTTPS Protocol with Two-Way Encryption. This protocol aims to protect the connection and the integrity of data transmission. This mechanism protects CoinEx from various cyber-attacks and prevents unauthorized account access;

-

Anti-Phishing System. Using this service, exchange users can verify the authenticity of domain names, emails, and TG channels. Additionally, an anti-phishing code can be set up to identify the source of incoming emails;

-

Account Disabling. In the event that a user's account is accessed by third parties, the exchange provides a feature to block the account and freeze funds;

-

Login Notifications. When an account is accessed, the system automatically notifies the user. The email will include the IP address and the time of the login;

-

IP Address Monitoring. Exchange clients typically use up to 3 IP addresses, which is considered normal. If addresses start changing frequently and do not repeat, the CoinEx system will send the user an email alert.

How CoinEx Protects Client Funds

As mentioned previously, the exchange's reserves are backed 1:1, meaning that in the event of a platform hack, CoinEx would be able to cover losses. Furthermore, according to CoinEx representatives, user funds are not used by the exchange, and a confirmation is always required for withdrawals.

The exchange stores user funds in cold wallets. A small portion is kept in hot wallets to ensure no delays in withdrawals, but all are covered by CoinEx insurance. Cold storage is the most secure method because private keys do not have constant network access. For added security, multi-signatures are used—multiple confirmations are required to withdraw crypto from these wallets.

The exchange regularly upgrades its security systems by collaborating with top specialists in the industry. The CoinEx Security Bounty program also helps by rewarding programmers who find bugs or vulnerabilities in the CoinEx system.

Why CoinEx is Safer than Other Exchanges

The CoinEx team does not use half-measures: numerous security partnerships and a generous bounty program allow them to quickly find and effectively eliminate vulnerabilities. While many exchanges neglect this, CoinEx does not. It is thanks to this approach that the exchange has never suffered a hack or exploit.

Registration and Verification on CoinEx

Registration on the exchange is only possible via email; account creation using a phone number is not available. To create a personal account, select "Sign Up" on the main page, then enter an email where a code will be sent—this code must be entered in the special field. This completes the registration process.

Regarding verification, CoinEx is one of the few exchanges where users have access to almost all platform features without identity confirmation. Here is a comparison table:

|

Option |

Account without Identity Verification |

Account with Identity Verification |

|

Withdrawal |

24h withdrawal limit: 10,000 USD 30-day withdrawal limit: 50,000 USD |

24h withdrawal limit: 1,000,000 USD |

|

Spot and Margin Trading |

Available |

Available |

|

Perpetual Contracts |

Available |

Available |

|

Financial Account |

Available |

Available |

|

Promotions and Offers |

Some |

Available |

Essentially, users without verification will not have access to certain promotions and will have limits on fiat currency withdrawals, meaning cryptocurrency can be withdrawn freely within limits.

If a user decides to undergo the verification procedure, it can be done as follows:

-

Select "Account Overview" from the dropdown menu under the user avatar;

-

Then select "Verification";

-

First, provide personal information: nationality, country of residence, full name, gender, date of birth, and document number;

-

Then, the CoinEx user will need to provide an identity document and complete a face recognition procedure via smartphone or PC camera.

Afterward, just wait for identity confirmation from the exchange, which takes between 1 and 3 days.

Trading Opportunities on CoinEx

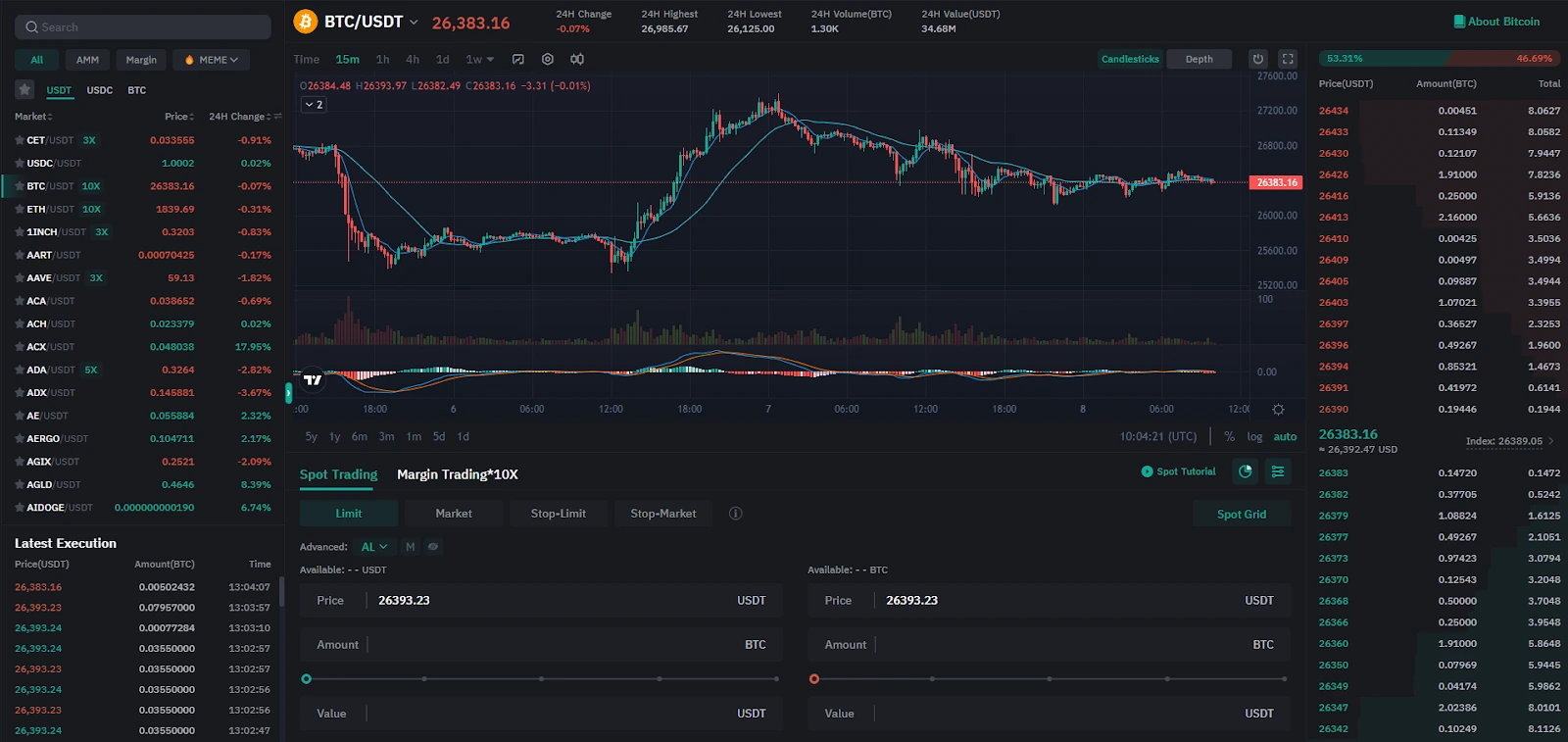

Spot Trading

The standard type of trading, which involves swapping one cryptocurrency for another. For example, if a user has USDT in their account, they can exchange it for BTC.

Margin Trading

Here, a trader can increase the size of their position by using leverage. For example, if a user wants to use 100 USDT to open a trade, applying 3x leverage increases their position to 300 USDT. This potentially increases profitability, but losses will also be magnified.

Futures Trading

Perpetual, linear, and inverse futures are available. A future is a contract to buy or sell an asset in the future at a pre-agreed price. The most common type in the crypto market is the perpetual future, which can be opened and closed at any time without an expiration date.

Order Types and Leverage Size

Four types of orders can be used on CoinEx:

-

Limit Order – An order to buy or sell at a set price and quantity. It will only be executed if the market price reaches the limit or a better price: execution is not guaranteed;

-

Market Order – An order to buy or sell immediately at the best current market price. This order is executed instantly based on the set quantity or amount;

-

Stop-Limit Order – A limit order where you set a trigger price, limit price, and quantity. When the trigger price is reached, your limit order is automatically placed;

-

Stop-Market Order – A market order where you set a trigger price and a quantity (or amount). When the trigger price is reached, your market order is automatically placed.

Available leverage on the platform:

-

For margin trading – 10x;

-

For perpetual futures trading – 100x.

CoinEx Fees

Trading Fees

Fees on CoinEx depend on trading volume, the amount of CET tokens on the balance, and the total value of assets:

|

VIP Level |

CET Balance |

Total Asset Value |

30-day Spot Vol |

30-day Futures Vol |

Spot Fee |

Spot Fee (CET deduction) |

Futures Fee |

|

VIP0 |

≥ 0 CET |

≥ 0 USD |

≥ 0 USD |

≥ 0 USD |

0.2% |

0.16% |

Maker:0.03% Taker:0.05% |

|

VIP1 |

≥2,000 CET |

≥ 10k USD |

≥ 20k USD |

≥ 20k USD |

0.18% |

0.144% |

Maker:0.028% Taker:0.048% |

|

VIP2 |

≥ 10,000 CET |

≥ 50k USD |

≥ 100k USD |

≥ 1m USD |

0.16% |

0.128% |

Maker:0.026% Taker:0.046% |

|

VIP3 |

≥ 50k CET |

≥ 100k USD |

≥ 200k USD |

≥ 2m USD |

0.16% |

0.112% |

Maker:0.024% Taker:0.044% |

|

VIP4 |

≥ 250k CET |

≥ 200k USD |

≥ 500k USD |

≥ 2m USD |

0.12% |

0.096% |

Maker:0.022% Taker:0.042% |

|

VIP5 |

≥ 1m CET |

≥ 500k USD |

≥ 1m USD |

≥ 10m USD |

0.1% |

0.08% |

Maker:0.02% Taker:0.04% |

Withdrawal Fees

When withdrawing cryptocurrencies, the exchange charges a fee to cover blockchain transaction costs; therefore, there is no fixed amount: the fee depends on the congestion of the specific cryptocurrency's blockchain.

When withdrawing fiat, the fee depends on the payment system and the currency. Note that the exchange supports specific regional methods like ADVCash for certain currencies, but support varies by region.

Payment Methods on CoinEx

You can deposit funds on CoinEx in three ways:

-

Cryptocurrency. Select the desired cryptocurrency in your account wallet, and the system will automatically generate an address to which you should transfer the digital assets;

-

Fiat Currency. As mentioned, the exchange supports fiat deposits via systems like ADVCash. The fee depends on the chosen fiat currency;

-

Via P2P Platform. Like many crypto exchanges, CoinEx allows users to deposit funds using local currency via its own P2P exchange. To do this, select "Buy Crypto" on the home page and click "P2P Trading." The user then selects the payment method, crypto price, and amount. After choosing an offer, the seller sends payment details, the user transfers the funds, and receives the crypto in their exchange wallet.

Additional CoinEx Services

Financial Account

This can be compared to staking: users leave their cryptocurrency for the exchange to use and receive a certain percentage in return. For example, by providing USDT to the platform, the annual yield is approximately 7%.

AMM

Any user with sufficient cryptocurrency can become a market maker on CoinEx. No extra effort is required: simply transfer crypto to the liquidity pool, and rewards (in the form of trading fees) will be automatically paid to your CoinEx wallet.

Crypto Loans

If a user needs USDT but doesn't want to sell their crypto, they can use the crypto loan service to increase liquidity. This is done as follows:

-

Go to the "Finance" tab on the main page and select "Loans";

-

Select the cryptocurrency to be used as collateral;

-

If the interest rate and term are acceptable, agree to the terms and provide the collateral;

-

USDT will be automatically credited to the CoinEx crypto wallet.

CoinEx Competitions

The exchange regularly hosts trader competitions with cash rewards in USDT or CET. Terms are usually consistent: whoever has the highest trading volume for a specific market within a set period qualifies for the prize pool.

Airdrops

By spreading information about new projects on social media or groups, users can receive new tokens. There are also airdrops from CoinEx itself: for example, by completing futures copy-trading training, you can receive 10 USDT.

Pros and Cons of CoinEx

Pros:

-

Provides services to a wide range of global users;

-

Low fees;

-

Opportunity to earn via airdrops;

-

Profitable crypto loans and financial accounts;

-

Large selection of trading pairs.

Cons:

-

Limited direct fiat withdrawals;

-

No live chat support;

-

Optional verification, which may affect security perception.

CoinEx Customer Support

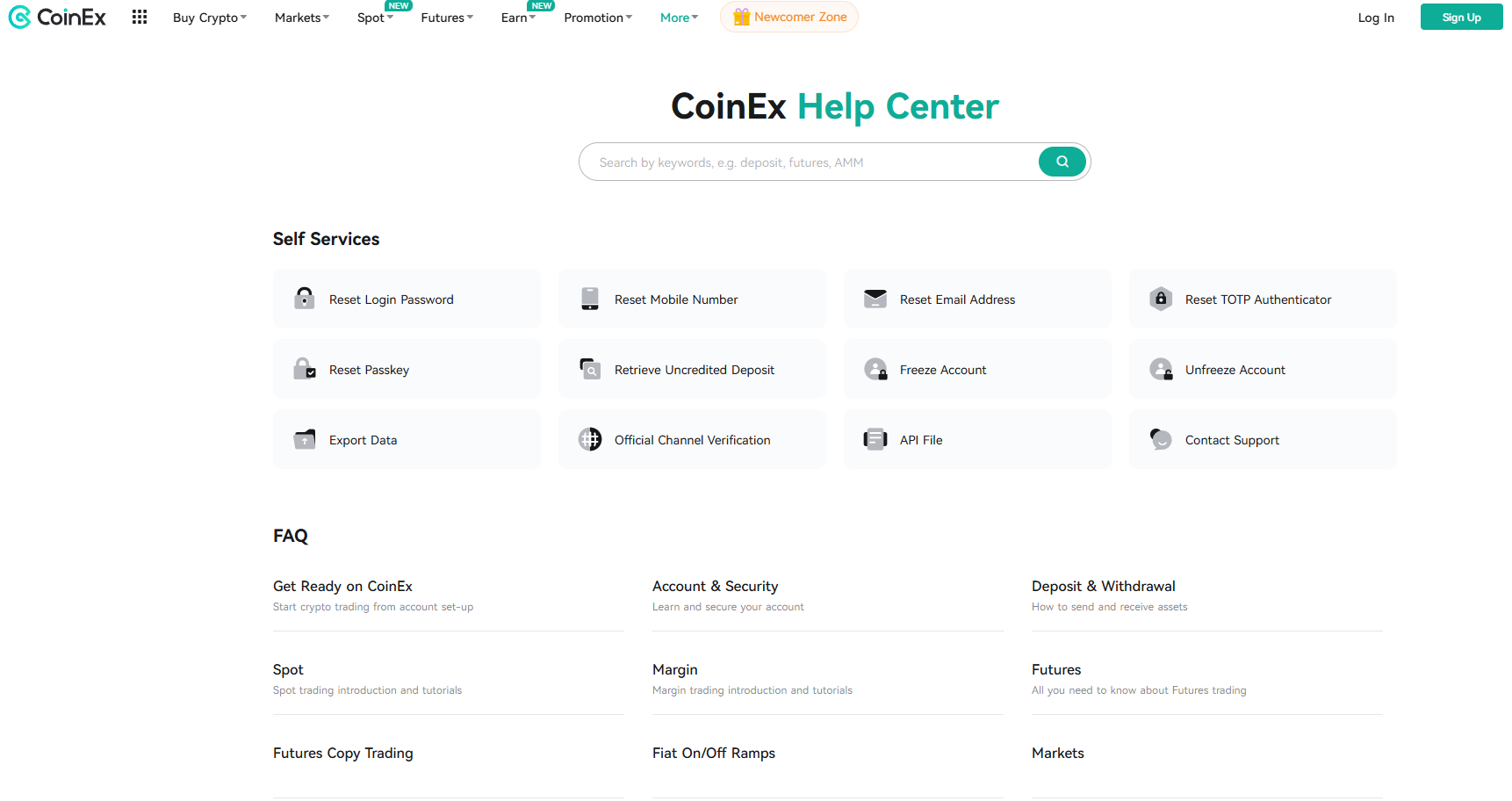

For some reason, CoinEx does not provide 24/7 live client support. To contact support, you must write an email or find a CoinEx social media account. Tickets are processed in a queue. Users report that it takes an average of up to 24 hours for a response, making urgent issues harder to resolve.

Users can attempt to solve problems independently using the CoinEx Help Center.

Conclusion

CoinEx is a convenient and secure cryptocurrency exchange that offers a wide range of trading tools, low fees, and flexible conditions for users. It is suitable for both beginners and experienced traders, providing access to spot, margin, and futures trading. Despite the lack of extensive fiat support and instant support, the exchange remains popular due to its reliable security system, favorable trading terms, and opportunities to earn through additional services such as financial accounts, crypto loans, and airdrops.

Arbitrage Scanner supports many exchanges for crypto arbitrage; you can find more details at this link.

FAQ

Can I use CoinEx without verification?

Yes, but with limits on withdrawals and access to certain promotions.

What is the available leverage on CoinEx?

Up to 10x for margin trading and up to 100x for futures.

What are the fees on CoinEx?

Spot trading – from 0.2% to 0.1%, futures – from 0.03% to 0.02% (maker) and from 0.05% to 0.04% (taker).

Does CoinEx support fiat?

Yes, you can top up your balance with local currencies via P2P or third-party systems like ADVCash.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.