What is a scam in cryptocurrency and how to avoid becoming a victim of fraud in 2025

with ArbitrageScanner!

What is a Scam in Cryptocurrency?

News about yet another scam in the crypto market regularly appears on the internet. In the cryptocurrency industry, the term "scam" refers to fraudulent schemes aimed at stealing funds from unsuspecting investors. Before the rise of digital assets, the term "scam" was not as widely used, but today, most scammers have found a home in the crypto market. The reason is simple—it's relatively easy to deceive beginners or uninformed investors, as there are numerous ways to steal money, and new schemes emerge regularly. However, tracking down those who have stolen funds is extremely difficult.

In this article, we will discuss well-known scam schemes, how to recognize them, and the largest thefts in the crypto industry.

Definition of a Scam

A cryptocurrency scam is a fraudulent activity where criminals create fake projects, services, or investment opportunities to steal money from unsuspecting or inexperienced users. Scammers use various methods to gain trust and convince investors to put their money into nonexistent or deliberately doomed projects.

At first, everything may seem legitimate. Moreover, modern scammers don’t immediately steal cryptocurrency. They first gain your trust, try to extract as much money from you as possible, and only then disappear with your funds. Unfortunately, in most cases, lost funds cannot be recovered. There is a slim chance that law enforcement agencies will catch the perpetrators and compensate for the losses, but this is an extremely rare outcome.

News about stolen funds appears regularly, but this does not completely protect people from scammers, even with detailed reports on fraudulent schemes.

Types of Scams

Fake Wallets

These are applications disguised as online wallets. You won’t find these wallets in app stores, but they can be downloaded from websites offering enticing deals like “Top up your balance and get $100 in wallet tokens.” The scammers provide an address that appears to be your wallet, but in reality, it belongs to them. Even if the balance is displayed, you won’t be able to withdraw funds, as the app is fully controlled by fraudsters.

Fake Exchanges and Exchangers

Scammers rarely develop entire exchanges or exchangers; instead, they create phishing sites that mimic well-known crypto platforms. For example, they may clone the Binance website with a domain like www.biinance .com. Users can log in with any credentials, as the site's only goal is to lure victims. If a user deposits funds on a fake exchange, their crypto goes directly to the scammers’ wallet.

Cloud Mining or Mining Bots

These scams promise passive income through mining software. The most common scams involve cloud mining and miner bots. Typically, such projects exist long enough to lure in investors, promising returns within a month. This delay allows scammers to attract a large audience and steal substantial amounts before disappearing.

Ponzi Schemes (Pyramid Schemes)

A classic fraud scheme adapted to the cryptocurrency market. Users are initially asked to invest in a scam pyramid and then recruit others, earning a commission for each new investor. The creators use new investors’ funds to pay previous participants and keep the remaining money for themselves. Once recruitment slows and payouts become unsustainable, the scheme collapses, leaving investors with losses.

Pump and Dump

Scammers artificially inflate the price of a low-value cryptocurrency by buying a significant portion of its supply or creating hype. As the price rises, other traders start investing, further driving up the price. When the token reaches a certain value, scammers sell their holdings at inflated prices, causing a sharp price drop. This leaves traders with devalued tokens while scammers profit.

Phishing Attacks

Fraudsters send emails pretending to be from exchanges, urging users to change their passwords due to alleged security breaches. Victims unknowingly enter their old and new passwords on a phishing site, giving scammers access to their accounts. Once inside, scammers withdraw all available funds.

Malware

Downloading software from unverified sources can install malware on your device, which may:

-

Mine cryptocurrency using your computer;

-

Steal private keys from your crypto wallets;

-

Capture sensitive login data.

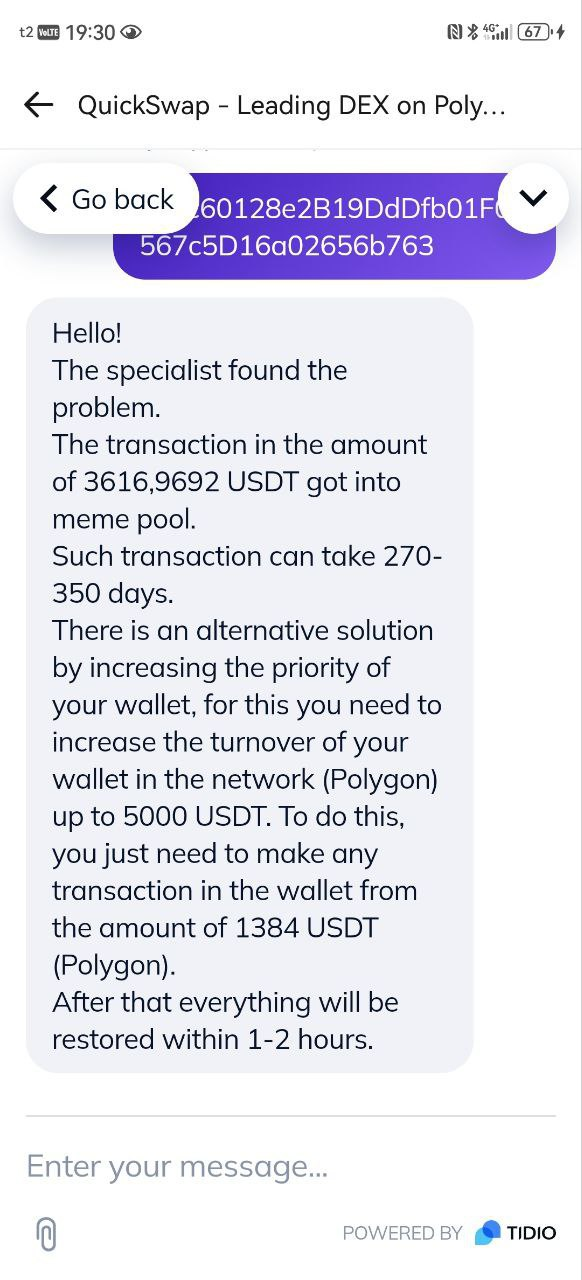

Fake Arbitrage Opportunities

Scammers claim to have found a profitable arbitrage opportunity and offer collaboration on "favorable terms" for a share of the profit. The scheme works as follows:

-

The victim is convinced to send money to participate;

-

Initial small transactions may succeed to build trust;

-

The victim is encouraged to invest more money;

-

Eventually, funds are blocked, and "support" demands additional fees to release them.

Fake Arbitrage Mentors

More sophisticated scammers pose as "mentors" offering to teach arbitrage trading. They gain trust, provide step-by-step guidance, and even show fake profits using manipulated exchanges and wallets. Initially, small transactions appear profitable, encouraging the victim to invest more. Eventually, the final transfer is blocked, and the scammer disappears.

Rug Pulls

Scammers launch a project, attract investments, and then suddenly abandon it, taking all the funds. This is especially common in decentralized finance (DeFi), where project creators have full control over user funds. A typical rug pull involves staking programs that promise high fixed returns. Once enough investors participate, the scammers shut down the project and disappear.

How to Recognize a Scam

-

Guarantees of high returns with minimal risks should raise red flags;

-

Lack of clear project information, documentation, or a roadmap;

-

Pressure to invest quickly to avoid "missing out" on an opportunity;

-

Claims of partnerships with major companies without proof;

-

Poor website design, grammatical errors, and lack of contact details.

How to Protect Yourself from Scams

-

Avoid offers promising quick and easy earnings;

-

Be cautious with recommendations from social media or messengers;

-

Never share your private keys or passwords with anyone;

-

Use hardware wallets for added security;

-

Enable two-factor authentication (2FA) wherever possible.

What to Do If You Fall Victim to a Scam

-

If the fraudulent transaction occurred on a centralized exchange, contact support immediately—it may be possible to freeze the stolen funds;

-

Contact the support team of your crypto wallet to try tracking the stolen assets;

-

Use blockchain analytics services like Chainalysis or CipherTrace to trace fund movements.

Holding Scammers Accountable

-

Report the fraud to law enforcement agencies, providing all relevant details, including wallet addresses and messages;

-

Notify specialized platforms to warn others in the crypto community.

Largest Thefts in Crypto History

-

Mt. Gox (2014): 850,000 BTC lost due to hacking, leading to the exchange’s bankruptcy.

-

Bitfinex (2016): 120,000 BTC stolen in one of the largest crypto heists.

-

PlusToken (2019): A Ponzi scheme that stole 200,000 BTC, 789,000 ETH, and 26 million EOS.

-

Poly Network (2021): $610 million stolen, though most of it was later returned.

-

FTX (2022): A top crypto exchange collapsed due to fraudulent operations and financial misconduct.

Conclusion

Cryptocurrency scams remain a major threat to investors and users. Staying informed and cautious is key to avoiding losses. While crypto offers many opportunities, only a well-educated approach can protect you from scammers. Following basic security measures can safeguard your funds from most fraudulent schemes.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.