Futures + Futures Strategy Quick Guide

Futures + Futures Strategy

In this strategy, we do not buy the actual coin.

We open two positions on futures markets across different exchanges: on one — a Long (bet on price increase), on the other — a Short (bet on price decrease).

Main Difference from “Spot + Futures”

1. Leverage: You can use leverage on both sides. This allows you to trade volumes that significantly exceed your actual capital.

Not for beginners. Risks increase.

2. Double Funding: You either receive or pay funding fees on both exchanges simultaneously. Our task is to calculate the final result (the sum of both funding rates).

Three Scenarios Considering Funding

An arbitrage trader always looks for the most profitable combination of price spread and total funding.

1. Ideal Scenario: Spread + Positive Funding

This is when the total funding from both exchanges generates additional profit.

· Option A: On both exchanges, funding pays you. (For example, on one exchange you are in Short and funding is positive, while on the other you are in Long and funding is negative.)

· Option B: On one exchange you receive more than you pay on the other.

Example: On Exchange #1 you are Short and receive +0.2%. On Exchange #2 you are Long and pay -0.1%.

Result: Your net funding income is +0.1% every 8 hours.

2. Basic Scenario: Spread Only

Funding on both exchanges is approximately equal and cancels out, or it is so small that it can be ignored.

· Example: On both exchanges funding is +0.01%. On one side you pay it, on the other — you receive it.

· Result: You break even on funding and profit only from price convergence between exchanges.

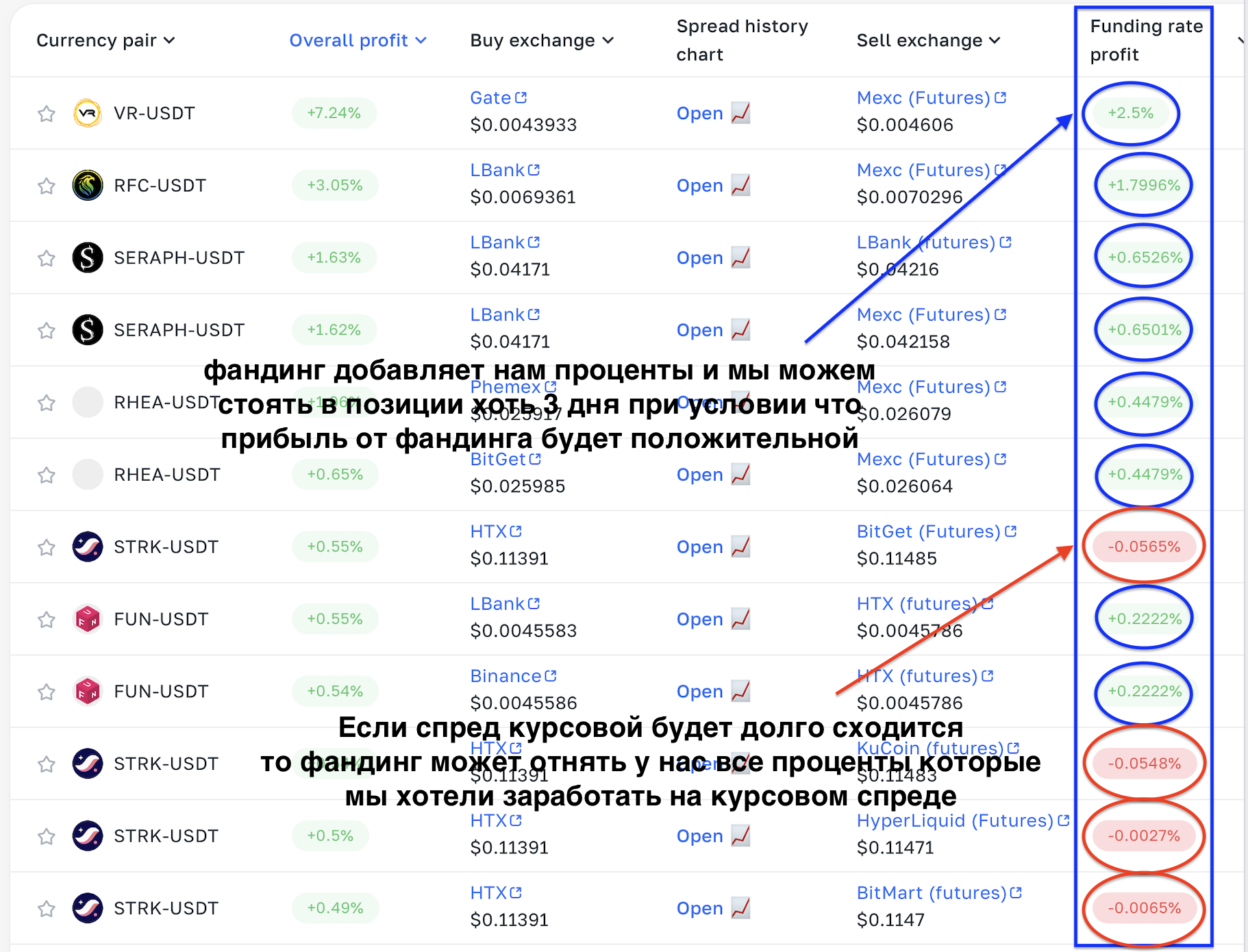

3. Spread Priority: Spread Is More Profitable Than Funding

This is when total funding is negative for you (you pay on both exchanges, or one pays less than the other takes), but the price spread covers these costs.

· Example: Over 24 hours you lose 0.05% on funding, but the spread between exchanges is 2%.

· Logic: It is still profitable to enter the trade, capture the 2% spread, and exit quickly without worrying about the small funding loss.

Important Rules for Futures + Futures:

1. Monitor Margin: If the coin price spikes upward, your Short will be at a loss while your Long will be profitable. You must have sufficient USDT reserve so the losing side is not liquidated.

2. Fees: You open two positions, so you pay opening and closing fees on both exchanges. On average, total fees across two exchanges range from 0.2% to 0.4%.

Checklist: How to Act Using the Futures + Futures Strategy

- Receive a coin notification from the screener or Telegram alerts.

- Verify that it is the same coin on both exchanges.

Sometimes coins have identical names but are different assets (this usually applies to spreads above 40%).

You can get a tutorial on how to check this from @demianscanner.

With experience, you will recognize this without verification. - Open the spread history chart and analyze it.

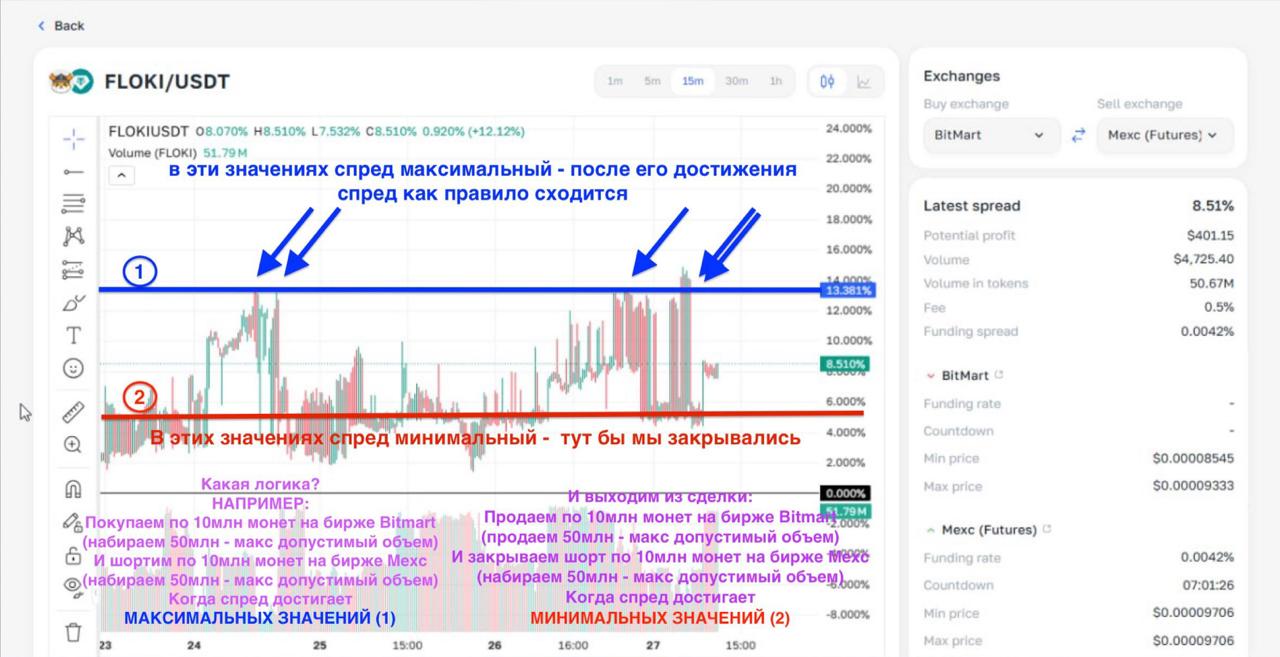

Example of spread chart analysis:

- If you see that the coin has diverged and converged before — analyze it like in the example above.

- If this is the first divergence — read further.

- First, check whether it is a delisting. If it is — it is better to skip such coins (if a delisting is announced, it means the coin will soon be removed from the exchange and the spread may widen further and never converge). If not a delisting — continue.

- Check trading volume on both exchanges.

It is important that volume exceeds $500,000 in USDT.

Also ensure funding does not significantly reduce your profitability.You can check this in the funding profit column:

How to understand when funding will subtract or add to your profit?

Continue reading in the training materials :) - You have analyzed everything — now comes the most important part: entering the trade correctly :)

- How to enter?

8.1. Start working with the order books.

How to work with them is described in this article:

Go to the article

8.2. It is important that entries on both sides are synchronized:

Open 50 coins in Long and at the same time 50 coins in Short

OR

Open 50 coins in Short and at the same time 50 coins in Long

(Depending on the short-term trend — if the 1-minute candle is rising, open Long first; if falling — open Short first.) - After entering, set a notification for spread convergence and occasionally monitor funding to ensure it remains favorable. (To track this specific coin, you can add it to the WHITE LIST.)

- Record all trade data in your tracking spreadsheet.

You can access it here, along with instructions on how to use it:

Go to the article - Once you receive a convergence notification or see that the spread has closed — exit the trade gradually using the order book and record the result in your spreadsheet.

P.S. At the beginning, I recommend sharing your trades with a manager or in a private chat — you will receive help everywhere :)

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.