Editorial team

CryptON

Position

Analyst

Education

Bachelor's degree in Economics and Master's degree in Statistics from Harvard University

Expertise

Analyticts, Investing

Private investor in the cryptocurrency sector since 2017

Trust fund manager

Analyst of ArbitrageScanner

Articles from CryptON

27/01/2025

What does Donald Trump buy?

How to make money with World Liberty Financial (WLF)? Discover where Donald Trump invests, the opportunities offered by this DeFi platform, and how it strengthens the US dollar as the global reserve currency

21/01/2025

Top memcoins for 2025

Memecoins have taken center stage in the latest crypto bull run, with public interest reaching unprecedented levels. New tokens and trading platforms have fueled the frenzy, while key market forces shape the trend. Although Ethereum and Solana dominate the spotlight with their ongoing rivalry, other major players have also emerged as significant contributors in recent months

28/12/2024

What AI agents are in cryptocurrency

Discover the best AI-powered crypto trading bots of 2025. Learn how artificial intelligence and blockchain technologies are transforming crypto trading, from automating transactions to building a stable token economy. A detailed guide on benefits, risks, and top solutions awaits you!

27/11/2024

Which meme coins does Murad invest in?

Learn everything about Murad Mahmudov — a crypto enthusiast who earned millions from meme coins. Discover the details of ZachXBT's exposé, hidden wallets, and how AI helps track his financial activity. We also explore why meme coins have outpaced traditional venture capital in the current bull market.

20/11/2024

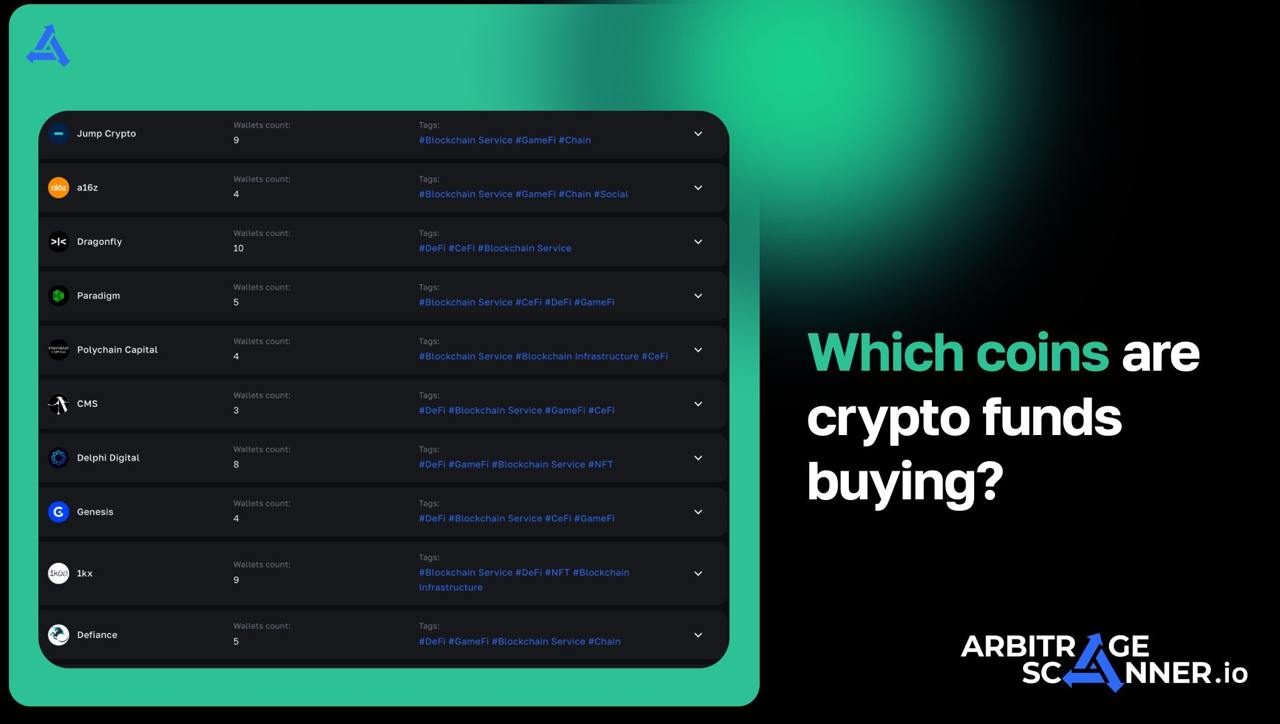

Which coins are crypto funds buying?

Discover which tokens venture capital firms are actively investing in this week. A detailed analysis of PEPE, OM, and POL investments, their market significance, growth rates, and holding volumes. Explore key crypto assets and the impact of VCs on the blockchain industry

12/11/2024

Why cryptocurrency memcoins are on the rise

Find out how NEIRO, KLAUS and Shiba Inu tokens are booming thanks to the activity of large investors. Learn about successful smart money strategies, their impact on the market and key examples of profitable investments. Follow the latest trends in the cryptocurrency market and learn how to capitalize on the movement of major players.

06/11/2024

How a trader made millions on memcoin

Ethereum traders are making big profits thanks to NEIRO and DOGE. A breakdown of their trades and the growth of the NEIRO token after listing on Binance. Find out what's behind their success and how the market is growing

30/10/2024

How to make money from AI in cryptocurrency

Discover promising investment opportunities in cryptocurrencies and AI in 2024! Learn how projects like VIRTUAL, GOAT, and other tokenized AI agents are transforming the crypto market, driving up valuations, and creating new monetization opportunities. Explore how artificial intelligence and blockchain projects on the TAO and Base networks are fueling explosive growth in meme coins, gaming NPCs, tokens, and DePin. Forecasts, insights, and tips for crypto investors — everything you need to know to profit from this emerging trend.

22/10/2024

How to find insiders on Binance

The article examines suspicious trading activities on wallets potentially linked to frontrunning on Binance. It analyzes transactions and profits to identify abnormal behavior before token listings. A list of wallets has been presented and added to monitoring for further tracking. Discover how insider information can impact the market and how analyzing wallets could help you profit.

15/10/2024

The unmasking of MrBeast

Learn why you should not blindly trust investments promoted by bloggers and influencers in cryptocurrency projects. In this article, we explore examples involving MrBeast, KSI, and others, discussing the risks and the importance of conducting your own research before investing in cryptocurrencies.

08/10/2024

How to earn on memcoins

Elon Musk and Donald Trump got the scoop at a rally in Pennsylvania, causing the PAC America and DMAGA tokens to surge. Musk announced PAC America on Twitter, causing a 70,000% rise in the America PAC token. Simultaneously, Vitalik Buterin mentioned MOODENG and EBULL in his tweet, causing EBULL to soar 1,000%. Learn how key figures in the crypto industry are influencing the market and how traders are capitalizing on it by reacting to social activity and real-time events

04/10/2024

How to Profit from Cryptocurrency Volatility

Learn how to effectively use the "Anomaly Detection" tool for analyzing wallets and trading cryptocurrencies. By following the actions of a successful blogger, a user detected anomalies in their transactions, which allowed them to replicate the strategy and profit from market volatility.

25/09/2024

Who hacked the Bingx exchange

In this article, we describe how user funds were stolen in the BingX exchange hack. The amount of damage in the BingX hack is $43M

13/09/2024

Top cryptocurrencies with growth potential

In this article, we discuss the top cryptocurrencies with growth potential. How to make money with cryptocurrency by investing in altcoins and how to find altcoins with growth potential is explained by the best on-chain analysis service – ArbitrageScanner.

11/09/2024

How to make money from venture capital investments in cryptocurrency

Pantera Capital is one of the first U.S. venture funds focused on digital assets and Web3 technologies. Learn how to profit from venture capital investments and understand the importance of on-chain analysis for tracking investment strategies.

07/09/2024

How to make money from insights in cryptocurrency

Discover how to leverage insider information in the cryptocurrency market to maximize profits. Explore strategies for finding key insights through on-chain analysis, filters, and AI on platforms like ArbitrageScanner. Track the actions of wallets belonging to developers, large investors, and venture funds, and analyze their strategies for successful trading. Learn from case studies of profitable trades and tips on risk management when using insider data for long-term gains.

02/09/2024

How to make 1000x by analyzing Smart Traders wallets

In this article, we will share a case study of how a Smart Trader, with a modest capital, turned it into millions of dollars. How to make 1000x by analyzing cryptocurrency wallets is explained by the best on-chain analysis service – ArbitrageScanner.

30/08/2024

Pavel Durov Arrest What Will Happen to TON

Pavel Durov Arrest. Impact on TON and Market Reaction. Learn how the freezing of the Telegram founder's assets and the concentration of validators in France have affected the TON blockchain and who profited from this news

27/08/2024

Crypto Whales Manipulate the Market

Discover how large crypto investors, known as "whales," manipulate the market and impact cryptocurrency prices. We explore recent examples, such as the sharp rise in $FET and the actions of major token holders. Learn how to profit from tracking large transactions using analytical tools and stay ahead in the world of crypto investing.

26/08/2024

What the Market Maker is buying

In this article, we will show how to use wallet analysis to find out what the Market Maker is buying. Our product line will help recognize when significant capital is preparing for a substantial price movement in assets. The best on-chain analysis service, ArbitrageScanner, explains how to identify the wallets of influential players, analyze their actions, and profit from such movements.

19/08/2024

Play-to-earn in cryptocurrency

The Play-to-earn industry in cryptocurrency has come a long way, from trading NFTs to becoming a full-fledged way to earn money. The future growth in cryptocurrency could significantly impact GameFi. Play-to-earn (P2E) is a concept in blockchain games built on play-and-earn mechanics. Most Play-to-earn games are designed as special tools with a financial incentive for gaming and progressing within it. You can earn in Play-to-earn games in various ways: from completing daily quests, collecting in-game currency, to staking. To start playing Play-to-earn games, all you need is a crypto wallet and to choose an interesting genre. Despite market volatility, large capital shows interest in certain coins from this industry. Using on-chain tools, we've compiled a top Play-to-earn coins list for 2024 that could delight their holders in the future.

14/08/2024

What is Bitcoin ETF and Ethereum ETF

The article explains: what is Bitcoin ETF and Ethereum ETF.

Bitcoin ETF and Ethereum ETF are a big step in the crypto industry, aimed at bringing digital assets closer to traditional finance. Having gone through a long process of fighting with the SEC, the Spot Bitcoin ETF was launched in early 2024. In the summer of 2024, after the success of the first cryptocurrency, the Ethereum ETF was launched.

12/08/2024

How funds and market makers profited from the market downturn

How large funds and market makers profited from the sharp market decline by taking advantage of the panic and strategically buying assets at the bottom

08/08/2024

What cryptocurrencies are celebrities investing in

Find out how celebrities like MrBeast, Jay-Z, Snoop Dogg and Justin Bieber are investing in cryptocurrencies. Explore what tokens they hold in their portfolios and how they use cryptocurrencies to make money